Naftogaz Ukrainy Chairman Andriy Kobolev in April 2014. (Gazprom)

Naftogaz Ukrainy Chairman Andriy Kobolev in April 2014. (Gazprom)

Ukraine’s Naftogaz Ukrainy has proposed restarting direct imports of Russian gas for nine months if Gazprom will allow it to replenish stocks before the winter heating season at a competitive rate.

Gazprom confirmed it had received a letter from the Kiev-based company, with the Russian export monopoly’s Chief Executive Alexei Miller, saying on Tuesday that it included a proposal to renew deliveries for the nine months running through H2 2016 and Q1 2017.

"The change in sentiment of the Ukrainian company is understandable. The daily volume of the reverse flow from Europe fell 84% in June in comparison with May, and by 94% in comparison with April," Miller said.

Naftogaz said in a statement that its position had not changed and that Gazprom must be competitive with its European suppliers on price. "The economically justified price of gas from Gazprom should be the ‘hub minus transportation’ price," Naftogaz said.

Finding financing

Naftogaz has also been trying to raise more funding from international finance groups to purchase gas imports, the company’s Chief Executive Andriy Kobolev told national TV on Monday.

A previous deal with the European Bank for Reconstruction and Development (EBRD) saw Naftogaz draw down on a $300 million package to fund its gas purchases before the 2015 heating season began, but a World Bank deal has so far not been finalised.

"We [have been] working on the [World Bank] loan for over a year […] We hope that this year this transaction would take place," Kobolev said on Ukraine’s Channel 5 TV station late on Monday.

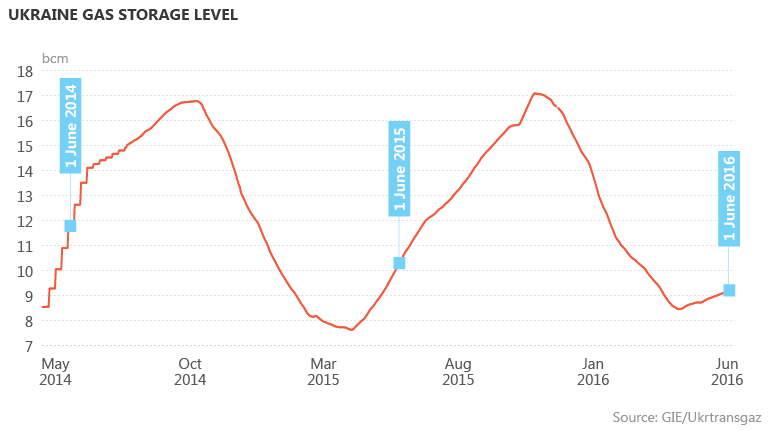

Ukrainian gas storage reserves are at their lowest level for the time of year since system operator Ukrtransgaz started reporting to the Gas Infrastructure Europe platform in 2014. This is likely to be putting pressure on officials in Kiev despite the continued slide in demand over recent months and associated fall in imports.

In May, Ukraine’s Energy and Coal Industry Minister Ihor Nasalyk said 8.2 billion cubic metres of gas would be injected into the country’s underground storage facilities before the winter heating season starts in October. That would take total inventories to around 17 bcm, but would also require importers to source approximately 2 bcm per month.

To do this, Naftogaz is understood to be planning to once again draw down on the ‘revolving’ account it opened with the EBRD in Q3 2016. Kobolev said on TV that he expected there would be more bidders this year than the 11 that took part in the open tender process last year.

"We expect that the pool of companies that would pass the qualification procedure would expand. I think that their number would reach 15. I anticipate that competition this year would be higher, as we proved that we are a high-quality contractor," he said.

At a summit in Peru in October 2015, Naftogaz announced an EU-secured debt package with the World Bank and European Investment Bank worth $520 million for the purchase of gas from both Europe and Russia.

"It would be right to buy gas from the east direction from the view point of minimising consumers’ expenses […] if Gazprom agrees to temporarily amend the existing contract, in this certain case, if the price is lower than the one have from the European direction," he said.

Kobolev is expecting a judgement on the Stockholm arbitration court case in late 2016 or early 2017 regarding the terms of the 2009 contract and associated transit arrangement.

"We assess the total cost of the two lawsuits for Ukraine, the potential gains that we could receive, is around $50 billion. This is both for the contract to buy gas and the gas transit contract. This is a strategic issue for us. We hope that at the end of this year or early next year we will be able to bring final decisions in the two lawsuits to Ukraine," he said.

But Kobolev added that Ukraine opposed Gazprom’s proposal to unite the two lawsuits into one. "We believe that independent lawsuits speed up the process and increase the likelihood of success for us […] The Arbitration Institute backed Naftogaz in this matter," he said.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].