Gabriel Obiang Lima, Equatorial Guinea’s energy minister, announcing the bidding round. (Africa Oil & Power)

Gabriel Obiang Lima, Equatorial Guinea’s energy minister, announcing the bidding round. (Africa Oil & Power)

Equatorial Guinea’s minister of mines, industry and energy launched a new licensing round in Cape Town on Monday and affirmed that Ophir Energy will take an FID on its planned 2.2 mtpa Fortuna FLNG project by the end of the year.

Gabriel Mbaga Obiang Lima told journalists at the Africa Oil & Power conference he is confident that the global oil price is on the rise.

"I want to be clear that this slump in oil prices is almost [over] – it’s very important that we keep promoting [oil and gas exploration] activity. We need to make sure the companies don’t get discouraged because of this oil slump, which has nothing to do with Africa – it is international prices," he said.

Lima also announced that Brazilian company G3 Oleo e Gas has made a gas discovery in Block EG-01 offshore Equatorial Guinea. While the drilling results are still being processed and it is too early to say what they will do with the gas, there is a "high probability it will be taken onshore to be used to develop domestic power or petrochemicals projects. Electricity is a key priority for us", Lima told journalists.

The auction will feature all of Equatorial Guinea’s blocks that are not operating, under operatorship or under direct negotiation. Of the 37 blocks on offer, 32 are offshore, some of which are deepwater concessions. The round closes on 30 November, the winners will be announced in mid-January, and negotiations will be concluded and PSCs signed by June 2017.

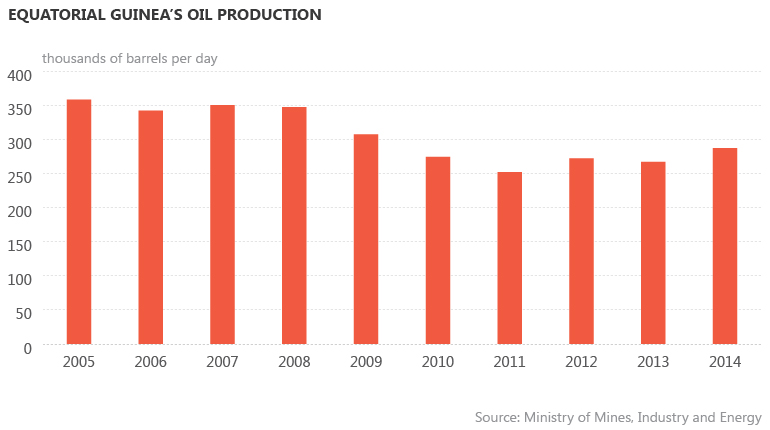

Equatorial Guinea – one of the most oil-dependent countries in the world – held licensing rounds in 2012, 2014 and again this year in an effort to stem its declining production rates.

"It’s important that everyone keeps looking for more to make sure that we continue developing oil and gas – that is a very important role for the IOCs, the NOCs and also the host countries," Lima said.

Ophir to gamble on Fortuna

Meanwhile, Ophir Energy is confident it can take an FID on its Fortuna FLNG project by the end of the 2016 and ship its first LNG by 2020, even though oifiled services company Schlumberger pulled out in April.

Under a non-binding heads of agreement signed in early 2016, Schlumberger agreed to take a 40% stake in the project and bear up to 50% of Ophir’s past costs. However, after conducting an extensive due diligence review Schlumberger decided not to continue with the project.

"One of the key bits of feedback was that, in terms of the project technically, there was no issue – there were no ‘red flags’ was the phrase that was used," Oliver Quinn, director of Africa and global new ventures at Ophir, told Interfax Natural Gas Daily. "They didn’t give a huge amount of info on why they didn’t wish to continue, but it was a clear message that they’d had a conversation at senior level and no longer wished to participate in the equity investment,"Quinn added.

However, after receiving engineering, procurement, construction, installation and commissioning bids in April the forward upstream capex requirement from FID to first gas was reduced from $600 million to $450-500 million.

Given this further reduction in the upstream project costs and the "extremely strong interest" in the LNG offtake contracts, Ophir can now proceed with the project without bringing in a new partner, Quinn said.

The company will either look to debt finance the project or, more likely, one of the LNG offtakers will provide buyer financing – a loan secured against the gas as part of an offtake contract – to cover the majority of Ophir’s upstream capital requirements. Ophir now has a shortlist of three potential LNG buyers and is in detailed negotiations with those parties to contract either half or the full output volume from Fortuna.

One of the key advantages to the project is that it is cheap, with a breakeven price of roughly $5/MMBtu – making it competitive with Henry Hub-linked LNG exports from the United States, Quinn previously told Interfax Natural Gas Daily.

The company has not ruled out bringing in another player. "If there was an equity partner out there that added value, then yes we’d consider that, the door is open, but right now we’re focused on going ahead with control at 80% and using that potential buyer finance source to get the upstream funded," Quinn said.

Negotiations for LNG sales agreements, the host government agreement and the midstream chartering agreement with Golar – which is providing the FLNG vessel for the Fortuna project – should be completed by mid-year.

The wells on the Block R licence are prolific, Quinn said, leaving plenty of opportunity for expansion. Ophir plans to put a second 2.2 mtpa FLNG vessel on site by 2027.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].