A gas-fired distributed generation project in Shanghai’s Hongqiao area. (Interfax)

A gas-fired distributed generation project in Shanghai’s Hongqiao area. (Interfax)

The slowdown in China’s gas demand growth, which fell to single digits in 2014 and 2015, rocked both the domestic industry and international suppliers. But officials believe gas-fired power, as well as efforts to promote gas over coal, will drive consumption over the next five years.

Power generation accounted for 15% of China’s gas use in 2015, according to the Economics & Technology Research Institute of China National Petroleum Corp. This compares with 60% in Japan, 35% in the United States and 28% in the UK, said Han Jingkuan, vice president of PetroChina’s strategic research institute.

Gas power will mark the next stage of Chinese gas development, after city gas and chemicals underpinned the rapid growth seen over the past five years, Han told Interfax Natural Gas Daily.

"The share of gas use from power generation will increase significantly," said Han. Gas used by residential users and chemical factories accounted for 25.4% of overall demand in 2014, but this figure will fall to 17% in 2020, he added.

China had 66 GW of installed gas-fired capacity at the end of 2015, up by 16.5% from the previous year, according to data from industry body China Electricity Council. Gas generated 165.8 TWh of power in 2015, an increase of 24.4% year on year.

Distributed generation

Han predicted China’s gas-fired capacity will increase to more than 66 GW by 2020, with 58 GW coming from traditional power plants and 3.8 GW from distributed generation projects.

He forecast the sector’s gas use would hit 26.7-32.5 billion cubic metres per year by the end of 2020, of which 21-22% would come from gas power plants and distributed projects.

Distributed generation looks set to surge in coming years as energy efficiency becomes increasingly important. Distributed generation produces electricity on-site or close to the point of use and usually makes use of the waste heat.

Han forecast that 190 new distributed generation projects will be added between now and the end of 2020 compared with 75 gas power stations.

"Local authorities and companies prefer distributed generation over gas power plants because the former is more energy-efficient," Guo Jiaofeng, a researcher at the Development Research Centre of the State Council, told Interfax Natural Gas Daily.

Local authorities are set to implement policies such as low gas prices and subsidies to encourage the development of gas-fired distributed generation projects, said Guo.

An effort to promote gas over coal to cut pollution will be another growth driver. "The switch will be resolutely promoted over the next few years by local authorities, whose environmental track records are under scrutiny from Beijing," said Han.

Han predicted the Yangtze River Delta, Pearl River Delta and central zones of the Bohai Economic Rim will have completed the switch to gas from coal by 2020. Demand from factories switching to gas from coal will reach 61.6-71.8 bcm/y by 2020, accounting for 22-23% of total gas consumption by then.

Diminished demand

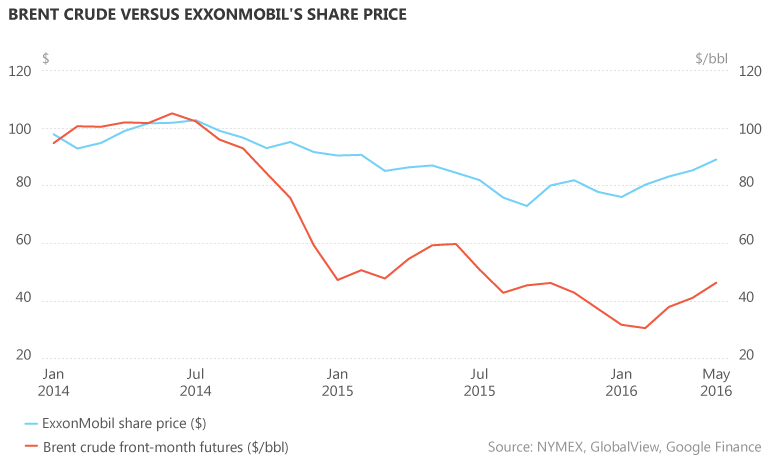

Han and Guo agreed the outlook for gas-fired power generation and coal-to-gas switching has been diminished by the global oil price slump and China’s ’new normal‘ of slower economic development.

Han forecast China will consume 260-320 bcm/y by 2020. This is in contrast to April 2015, when he forecast consumption would reach 320-360 bcm/y by then.

Han attributed his lower estimate to the high cost of gas in comparison with other fuels. "Gas doesn’t have a price advantage against oil products and coal. I also doubt whether gas promotion policies can be completely implemented and market reforms can be smoothly conducted," he said.

Guo was more optimistic, estimating consumption could reach 360 bcm/y by 2020 – the same as a November 2014 government forecast.

"Our research indicates the price of LNG is 70% of diesel on average, which means LNG has the price advantage at present. The advantage will be larger with further pricing mechanism reform and more incentives from authorities’ policies," Guo said.

Gas demand from the power sector and industry has jumped in some provinces since the government cut gas prices last November.

Gas-for-power use in Henan surged by nearly 500% year on year, to 231 million cubic metres, between January and April, according to the Henan arm of the National Energy Administration, which attributed the spike to the price cut.

Chongqing used 3 bcm over the same four months, of which 1.74 bcm was consumed by factories – an increase of 30.2% from the previous year, municipal government data showed.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].