Japan’s ‘third arrow’ will split utilities

Tepco has suffered with nuclear plant shutdowns and multi-billion dollar losses in recent years. (Tepco)

Tepco has suffered with nuclear plant shutdowns and multi-billion dollar losses in recent years. (Tepco)

Japan has fired the ‘third arrow’ in its three-pronged reform of the domestic energy market – approving two bills last week that will pave the way for the unbundling of transmission and distribution units currently controlled by integrated power and gas utilities.

The bills provide the final phase of programmes designed to overhaul both the gas and power sectors, Japan’s Ministry of Economy, Trade and Industry (METI) said on 3 March after the cabinet gave its approval. However, the bills will still need to pass through the Diet, Japan’s parliament, before they can be finalised.

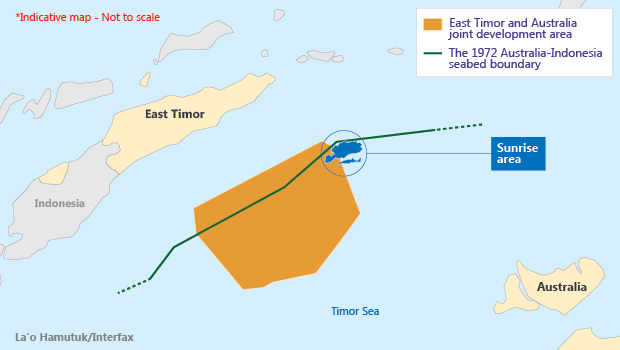

Both programmes require Japanese utilities to separate their power transmission and gas distribution units, which will make room for new companies to enter the market and allow third-party access to the country’s 23 LNG terminals.

The plan to unbundle gas pipeline networks and create network neutrality in the sector is expected to take effect by 2022, according to METI. Full liberalisation of power transmission grids and retail electricity rates, meanwhile, is expected to take place two years earlier.

Prime Minister Shinzo Abe’s ‘three arrow’ programme – also known as ‘Abenomics’ – is designed to kickstart the Japanese economy, which slipped into an unexpected recession in 2014.

Although the government’s power sector reforms have been under discussion for the four years since the Fukushima accident, the government’s plan to allow independent access to gas pipelines was a relatively recent addition to its broader scheme for energy reform, Tom O’Sullivan, founder of Tokyo-based consultancy Mathyos Energy, told Interfax.

While the reforms could allow private and foreign companies access to electricity transmission and gas distribution grids, the bill forces utility monopolies to legally divide their power and gas businesses rather than spin the assets off to new owners. This means they could still retain the means to block new entrants looking to supply renewable energy.

"There are some concerns about this because [utilities’] holding companies will still own the power grids here in Japan, and this may inhibit the amount of renewable energy that can go into the grid," O’Sullivan said.

"The power companies don’t own any of these [renewable] generating assets, so they are not incentivised to accept outside power sources, and would rather have their proprietary generating assets – gas, coal and nuclear – running at full throttle," he added.

There are also concerns about provisions in both bills that would allow deregulation to be delayed if the supply and financial conditions are considered unfavourable for utility companies.

Embattled Tepco – Japan’s largest utility – could be the worst hit by the reforms, O’Sullivan said. The size of Tepco’s power market in the Kanto region is likely to attract outside players, while the company’s poor reputation could see customers keen to switch to a different supplier when presented with alternatives.

Nuclear restarts

Tepco has taken blow after blow in recent years – including nuclear shutdowns, radioactive leaks and multi-billion dollar losses – and has only been kept afloat by injections of government capital.

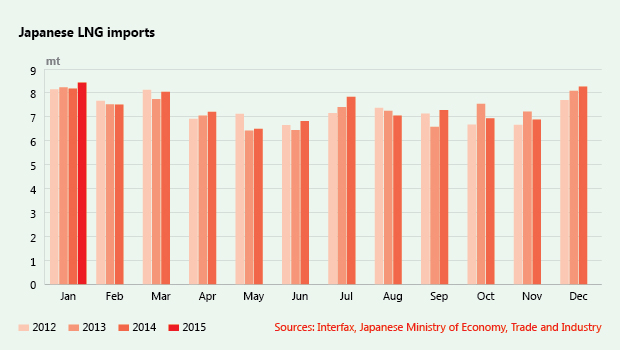

Although the fall in Asian LNG prices over the past year has brought some relief to Japanese utilities, uncertainty around the restart of nuclear power plants still weighs on their prospects.

The Nuclear Regulatory Authority (NRA) has so far approved the restart of four reactors – Kyushu Electric’s Sendai 1 and 2, and Kansai Electric’s Takahama 3 and 4 – but their return continues to be pushed back. The Sendai reactors were initially expected to restart by early 2015 but could now be delayed until after the summer, a METI representative said last month in London.

Nevertheless, restarts are likely in the next few years. "In the absence of further delays, approximately 40% of Japan’s pre-Fukushima reactors could be operating by the end of 2017," analysts at Goldman Sachs said in a report last week.

This would reduce the share of gas-fired generation in Japan’s power mix from 37% to 31%, which is slightly higher than its pre-Fukushima level, the analysts said. That would cause LNG imports to slip from a record-setting 88 mt in 2014 to 86 mt in 2017.

Japan’s Institute of Energy Economics has forecast that up to 10 GW of nuclear power – out of 42 GW before the Fukushima accident – could be restarted this year.

However, delays in the NRA’s reactor approval process and ongoing legal challenges could limit the number of restarts to just four this year – with a combined capacity of 3.5 GW, O’Sullivan said, adding that the legal challenges could pose a "serious threat" for nuclear generation.