Malaysia’s Petronas unwavering in its LNG ambitions

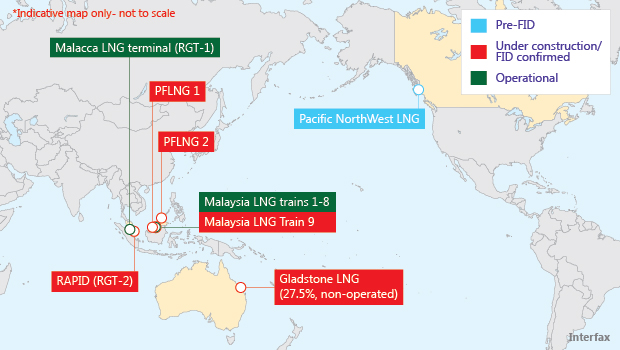

Petronas’s LNG projects in the Pacific.

Petronas’s LNG projects in the Pacific.

Petronas’s first quarterly loss and the bearish outlook for the oil and gas market do not appear to have curtailed the Malaysian NOC’s plans to add to its LNG portfolio, following the announcement of new investments and reassurances major projects will not be affected by spending cuts.

Petronas lost MYR 7.3 billion ($2 billion) in Q4 2014 as a result of significant impairments from the fall in crude oil prices and a 6.9% year-on-year decline in revenue.

The loss is expected to herald a lean period, with reduced earnings and spending. Petronas confirmed at a press briefing in Kuala Lumpur last week that it planned to reduce its capital expenditure by 10% in 2015 and 15% in 2016.

In line with these cuts, Moody’s expects the group’s annual capex to average MYR 50 billion this year and next, Rachel Chua, associate analyst at the ratings agency in Singapore, told Interfax.

The spending cuts are likely to affect certain projects in the company’s development pipeline, as well as the risk service contracts it awards for enhanced oil recovery at its marginal fields in Malaysia, the company acknowledged.

"Some key projects will be deferred. The Sepat gas processing project will be consciously deferred until 2017 or 2018," said outgoing Chief Executive Shamsul Azhar Abbas, according to Malaysian newspaper The Star. That development is part of an initiative to gather associated gas from producing oilfields such as Sepat.

But while some projects will be deferred and spending will be cut, Petronas appears committed to focusing its investment on LNG projects – including new liquefaction capacity at home and abroad, and a second regasification terminal in Peninsular Malaysia.

Spreading costs

Petronas’s decision in December to defer the FID on its Pacific NorthWest LNG (PNW LNG) project – a two-train, 12 mtpa plant in western Canada – led to concern the project could be shelved.

However, Shamsul indicated during the Q4 briefing that the PNW LNG joint venture now expects to reach a decision by the end of June, and noted construction costs in Canada are falling as a result of the decline in oil prices.

Petronas should be able to commit to the project without feeling too much financial strain over the next two years, Chua said. "If there is an FID in June, we expect Petronas to maintain its prudent approach in financing the capex with a mix of cash and borrowings such that its credit metrics remain within the parameters of its ratings."

Petronas may also be on the verge of reducing its capital costs in the project from $35 billion at present. It is in talks with a Chinese buyer for it to take a 10-12% stake in the project.

The Malaysian company has already sold 38% of the project to five buyers from China, Japan, India and Brunei. With this next deal, the operator would achieve its goal of reducing its stake to 50%.

The prospective buyer is likely to be either China National Offshore Oil Corp. or PetroChina – the listed arm of China National Petroleum Corp. – a Calgary-based industry source told Interfax. China’s third large NOC, Sinopec, already has a 15% stake in the project and a commitment to import at least 4.4 mtpa – and smaller players would probably be unable to import the 1.2-1.4 mtpa the share would provide – the source added.

Pressing ahead

In addition to PNW LNG, Petronas also said it plans to save its second Malaysian regasification terminal from spending cuts. The terminal is part of the massive $16 billion RAPID petrochemical complex in the peninsular state of Johor.

Petronas approved the project in April 2014 and awarded the contract for engineering, procurement, construction and commissioning of the 3.5 mtpa import terminal, known as RGT-2, to Samsung C&T in November – with the aim of completing it in 2018.

Meanwhile, the company has a ninth 3.6 mtpa train under construction at its Malaysia LNG complex in Bintulu, and another 2.7 mtpa of capacity on the way from two new FLNG plants (PFLNG 1 and PFLNG 2).

Petronas expects the ninth train and PFLNG 1 plant to start up in 2016, although there has been speculation they could be delayed by a year. PFLNG 2 is expected in early 2018.

Petronas and its subsidiary MISC, which operates LNG carriers, announced last month they had agreed to buy five new LNG vessels from Hyundai Heavy Industries for $1.1 billion, which will be delivered between September 2016 and December 2017.

In addition, Petronas agreed to extend its charter for five of MISC’s LNG carriers for another 10 years, to be delivered between September 2015 and September 2017.