Maputo’s auction open to corruption and delay – CIP

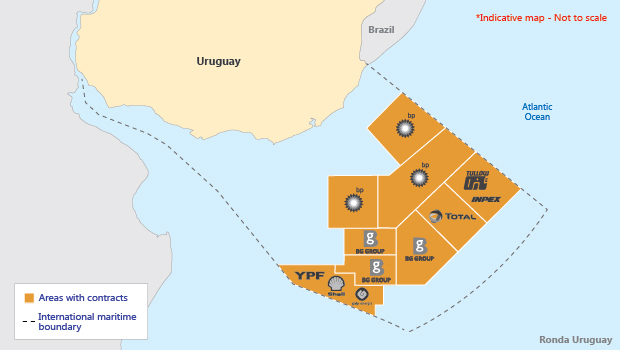

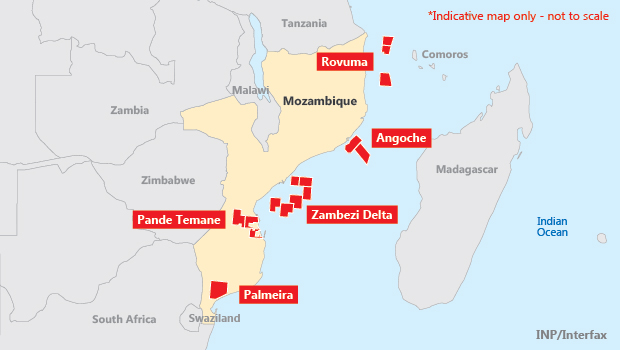

The blocks on offer in Mozambique’s fifth licensing round.

The blocks on offer in Mozambique’s fifth licensing round.

The failure of Mozambique’s petroleum regulator INP to publish key documents relating to the country’s fifth exploration licensing round means the auction – which is scheduled to close on 30 April – is likely to be postponed for a second time.

Meanwhile, the government’s new preference for bids to include domestic partners has been criticised for "opening the door for Nigerian-style corruption", according to a new report by Maputo-based thinktank the Centre for Public Integrity (CIP).

Mozambique launched its fifth licensing round on 23 October last year – just two months after the government passed its new petroleum law, but before the INP had drafted its new petroleum regulations and model production-sharing contract (PSC).

The petroleum law introduced several unexpected and controversial requirements on foreign petroleum operators, including a 25% domestic market obligation, preference for licence bids with Mozambican partners and a requirement companies list on the country’s stock exchange – which took even state oil company ENH by surprise.

Observers have since been expecting the INP’s forthcoming regulations to iron out some of the law’s more severe implications. Jose Branquinho, a project manager for INP, told Interfax in November the model contract would be available on the regulator’s website "soon". But nearly five months later, neither the model PSC nor the regulations have been finalised.

The INP had already delayed the close of the licensing round in late December – from 20 January to 30 April – at the request of oil companies that wanted more time to pull together bids. "There is now speculation the bidding round will be extended a second time while companies wait for clarity on the petroleum regulations and the model contract," according to the CIP report.

This tactic may be deliberate, an industry source in Maputo told Interfax. With oil prices low, the delay in publishing the model PSC and regulations – and, consequently, postponement of the licensing round – may be intended to provide more time for prices to recover and ensure the bidding is more competitive.

However, in Mozambique – and East Africa in general – it is not the price of oil, but fiscal terms and the prospectivity of exploration blocks that are more likely to influence IOC interest in bidding rounds, said Harriet Okwi, a senior analyst in IHS Global’s Africa Oil & Gas team. "What we may see is IOCs negotiating lenient exploration commitments that factor in the weak and uncertain oil price," she said.

The INP has ignored repeated requests for comment over the past few weeks.

Open to corruption

The CIP report goes beyond criticising the INP for mismanaging the bidding round, saying the vague criteria used for assessing financial proposals – and the lack of information over the preference offered to bids that include Mozambican partners – "suggest that there are real risks that the process is being manipulated".

The awards process ignores best practices for concession allocation by not requiring bidders to prequalify and by offering more than 15 biddable elements in the selection process, the report said. The International Monetary Fund had recommended the INP offer only one biddable element.

Of particular concern is the criteria that will be used for assessing the ‘other terms’ listed under the financial proposals section of the bidding documents – which relate to nearly 20% of the overall application score.

In response to bidders’ questions on what these ‘other terms’ are, the INP wrote: "The score for ‘other terms’ is calculated from the INP’s own ‘confidential’ economic model that contains all the variables, including R-factor, expenditure, production bonus, carried ENH interest, etc."

This "’black box’ decision-making process is not reassuring", the CIP warned.

Preference for local partners

Article 26 of the Petroleum Law gives Mozambican companies – and foreign companies associated with those companies – pre-emption rights in the granting of concession contracts. However, the INP has not offered any clarity on how far these rights extend.

"The lack of clarity on whether a national partner is required, and how competing bids would be evaluated with and without such a partner, opens a very large door for potential corruption," the CIP said.

There is a risk domestic partners will be shell companies owned by influential local investors, which will not have the intent or expertise to develop gas resources, according to a World Bank report into corruption in the oil sector. As has been common in Nigeria, local companies may win valued exploration rights "on a favoured, non-transparent basis, only to turn around and ‘farm out’ these rights to qualified international operators for very significant sums", the World Bank said.

While it may be too late for Mozambique to scrap the licensing round and relaunch it to be closer in line with industry best practices, the least the INP could do is introduce an additional layer of oversight – possibly including international observers – to ensure the fairness of the adjudication process, the CIP said.

EPCC fifth licence round, bid evaluation score

| Appendix A | Applicant details and financial information | 5% |

| Total investment in E&P exploration | 1 point | |

| Value (market cap) – small to large | 2 points | |

| Production of oil and gas | 1 point | |

| Affordability of work programme bid | 1 point | |

| Applicant technical expertise | 8% | |

| Number of E&P wells drilled | 2 points | |

| Technology – relevant to area | 4 points | |

| Number of discoveries | 2 points | |

| Appendix B | Technical work programme | 50% |

| Technical database | 8 points | |

| G&G evaluation already completed | 10 points | |

| Licence prospectivity | 4 points | |

| First exploration period | 22 points | |

| Second exploration period | 5.5 points | |

| Third exploration period | 0.5 points | |

| Appendix C | Financial proposal | 37% |

| Training | 2 points | |

| Institutional support | 5 points | |

| Social support | 2 points | |

| State participation (ENH) | 5 points | |

| Production bonus | 4 points | |

| Other terms | 19 points | |

| Appendix D | HSE | |

| Pass or fail | ||

| Health safety environment |