Nuclear in Asia – not all doom and gloom for gas

Restarted nuclear reactors are displacing gas in Japan’s power sector. (Wikicommons)

Restarted nuclear reactors are displacing gas in Japan’s power sector. (Wikicommons)

Japan’s restarted nuclear reactors are set to displace gas in the country’s power sector. Even if only a small share of Japan’s nuclear capacity is brought back online over the next 24 months, it will still dent gas demand. But the outlook is mixed elsewhere in Asia. While greater amounts of nuclear capacity will likely displace gas in South Korea’s power sector, the opposite is expected in Taiwan. Meanwhile, there is potentially room for both gas and nuclear to grow in China and India. So, even with rising nuclear output expected in the region, it is not all bad news for gas in Asia.

Declines for Northeast Asia’s other LNG giant

South Korea has been importing less LNG recently and its gas demand has fallen. The country’s LNG imports fell by around 10% on an annual basis in 2015, and further declines are expected this year. Nuclear and coal are displacing gas-fired generation in South Korea’s power sector. The offtake of gas from the power sector fell by 38% year on year in H1 2015, whereas coal use increased. Nuclear output is estimated to have risen by around 5% last year and is expected to rise this year.

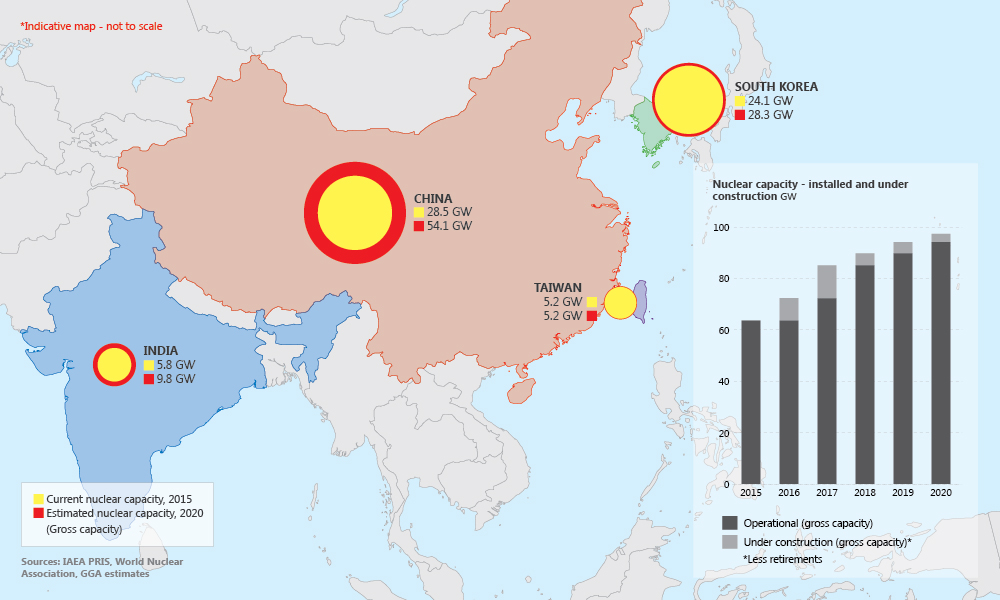

South Korea has around 24 GW of nuclear capacity, which generated around 30% of the country’s power in 2015. Around 1 GW of new nuclear capacity came online last year, and a further 1.4 GW has been connected to the grid so far in 2016. Another 4.2 GW of capacity is under construction and is likely to come online by 2020. Although South Korea’s nuclear fleet has faced hurdles in recent years – such as problems regarding safety certificates, which kept some plants offline – it is nevertheless set to expand. Some reactors will be retired over the next 10 years, but they will be more than compensated for by the new plants. So although South Korea’s gas demand is expected to recover by 2020, the fuel will continue to compete against nuclear for a share of the power market.

Big markets set for big growth

Nuclear power accounts for a small percentage of China’s generation mix. The country’s 28.5 GW of installed nuclear capacity provides only around 2% of its electricity production. However, the Chinese nuclear sector is set for world-leading growth over the next five years. With roughly 24 GW of new reactors under construction, China’s nuclear capacity is set to roughly double by 2020. Beyond this, a further 48 GW of new capacity is planned and more than 100 GW is proposed. Even if just half of the planned reactors are commissioned by 2025, China could have around 80 GW of operational nuclear capacity within the next 10 years.

China’s installed generation capacity has increased at a record pace over the past 10 years, with growth hitting more than 10% per year between 2005 and 2010. Although the growth has now slowed, the increase in terms of absolute generation capability is still staggering. Over 100 GW of new capacity was added in 2013, according to data from the China Electricity Council.

Against this background, nuclear power has made a strong showing. Nuclear output is estimated to have grown by around 30% in 2015 year on year, while China’s total electricity generation is expected to have grown by just 1%. However, it is coal rather than gas that is gradually being pushed out of the generation mix, a trend that is expected to continue. Although coal will dominate China’s power mix for the foreseeable future and its output will rise, its share of total capacity and output will fall. Therefore, while nuclear generation is expected to grow at a faster rate in China than anywhere else, it will not be at the expense of gas. Beijing plans to increase the share of gas in China’s energy mix to around 10% by 2020, meaning the share of gas in power generation will also rise.

India’s power sector is also dominated by coal, although nuclear holds a small position in the mix. The country has around 6 GW of nuclear capacity, which generates roughly 4% of the country’s electricity despite forming only 2% of India’s total capacity. India has around 175 GW of coal-fired capacity, accounting for 61% of the total, while gas languishes at around 25 GW and 9%.

India is building roughly 4 GW of new nuclear capacity. It is uncertain when the new plants will come online, but they could be ready as soon as 2020. If this happens, India will have around 10 GW of nuclear capacity in five years’ time, with more plants likely to come online during the following decade. The country is planning another 24 GW of nuclear capacity, with a further 38 GW proposed – giving it the world’s second-largest nuclear building plan after China.

There is scope for India’s power sector to grow substantially. Around 20% of the country’s population did not have access to electricity in 2013. India is working to enable access for the entire population, but this will likely take more than 20 years to achieve. Nevertheless, there is room for all generation sources to grow. Coal-fired generation will increase, but its market share will decline. Increased gas production and imports – via LNG and, potentially, pipelines – are also planned. This will support the expansion of gas-fired generation that the country has planned for the next 10 years.

Where nuclear struggles, gas will gain

Taiwan’s 5.2 GW of nuclear generation capacity accounts for around 16% of the country’s electricity output. This is provided by six operational reactors in three plants – Chinshan (1.3 GW), Kuosheng (2 GW) and Maanshan (1.9 GW). However, rather than planning to increase nuclear generation, Taiwan intends to decommission its reactors by 2025. This means that not only will the 2.7 GW of capacity at the long-delayed Lungmen plant never come online, but also that the generation from Taiwan’s existing nuclear power plants will need to be replaced.

Coal is Taiwan’s largest source of electricity, producing nearly half of the country’s power. However, the expansion of coal faces challenges on environmental and political grounds. Taiwanese officials attended the COP21 climate summit in Paris last December and pledged to reduce coal-fired output to help bring down emissions. As the country primarily imports coal from China, reducing Taiwan’s reliance on the fuel is also seen as having political benefits by some. This does not mean a phase out of coal is likely, however - despite environmental and political concerns. Nevertheless, increases in coal-fired power could be limited.

Taiwan also has ambitious plans to increased renewable generation. However, given the current low level of renewables in the mix, even if aggressive build out rates of renewables are realised, more gas-fired power will be required to meet the looming generation gap.

This is good news for Taiwan’s LNG imports, which grew by around 8% in 2015 to reach roughly 15 mt. Further growth is expected this year, and it will be supported by additions to LNG regasification capacity from expansions to the Taichung terminal and the commissioning of a third terminal. The new terminal will be located in northern Taiwan and will have a capacity of around 6 mtpa. It could be commissioned in the next six years.

On balance - Nuclear and gas will grow

Although the expansion of nuclear power in Japan and South Korea will come at the cost of gas over the coming years, nuclear is less of a threat to gas elsewhere in the region. Indeed - in Taiwan the decline of nuclear presents opportunities for gas. In China and India – market growth will be sufficient to require increased generation from both nuclear and gas. Gas will continue to face challenges from nuclear in Asia, but growth will be realised.