Oil prices may hurt data transparency initiative

An initiative to improve the transparency of energy data around the world appears to be struggling now oil and gas prices have fallen. (SXC)

An initiative to improve the transparency of energy data around the world appears to be struggling now oil and gas prices have fallen. (SXC)

The Joint Organisations Data Initiative (JODI) benefits from high level political support, but insiders worry about commitment to the project now producing countries’ budgets have been cut by low oil and gas prices.

JODI has published its oil databases since 2005 and unveiled a similar data offering for gas in May 2014. More than 100 countries are now part of the JODI-Oil initiative, representing more than 90% of world oil supply and demand. The gas initiative is only slightly less extensive, with nearly 80 members representing around 90% of world gas supply and demand. The seven JODI partner organisations are the Asia-Pacific Economic Cooperation forum, Eurostat, the Gas Exporting Countries Forum, the International Energy Agency, the Latin American Energy Organization, OPEC and the United Nations Statistics Division.

The JODI-Gas data set offers global coverage of natural gas and LNG production, imports, exports, stocks and demand on a monthly basis, while JODI-Oil provides a similar set of data for crude oil and oil products. But submissions are voluntary, so each month JODI puts out two spreadsheets showing the number of countries that have submitted oil and gas data for the latest and preceding months.

These spreadsheets naturally show a drop-off in participation in the most recent months because countries often submit their data late. Several countries also have stop-start regimes for submitting, so establishing whether and when a country has definitively stopped submitting data is difficult.

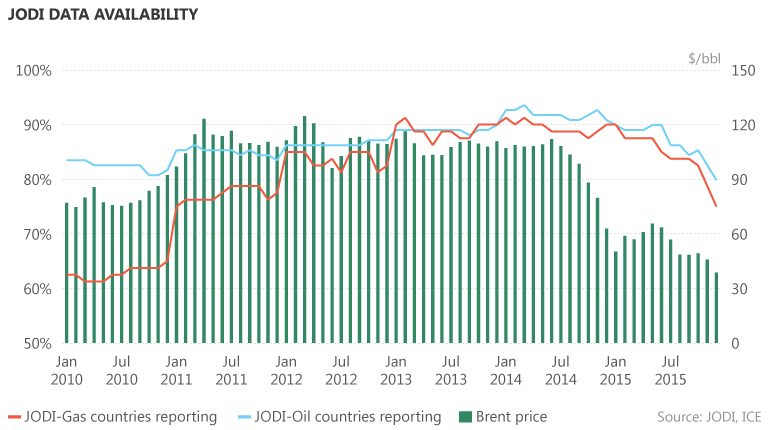

Nevertheless, looking at shifts in data submission over time, a rising trend can be seen up to mid-2014, when oil prices stood at more than $110 per barrel, and a gradually declining trend can be seen from around November 2014. The decline in data availability broadly tracks the decline in oil and gas prices from peaks of above $110/bbl in June 2014 to recent lows below $27/bbl in January 2016.

From the spreadsheet data, gas submissions by JODI members peaked in March 2014, when more than 91% of countries put in data. However, this declined to just 81% in the second half of 2015.

Thirteen countries have failed to submit any gas data since July 2015. These include LNG exporters such as Indonesia, Oman and Papua New Guinea; major oil and gas producers such as Iran and Venezuela; and large gas and LNG consumers such as Argentina. Among the countries that appear to have stopped sending gas data is Qatar, which has not submitted any since March 2015 but had submitted data from early 2013.

The oil data submissions appear to follow a similar pattern, peaking in March 2014 when 93.5% of countries submitted data, but declining to only 84% on average in the second half of 2015. Some of the big OPEC producers, such as the UAE, which have supported the data transparency initiative in the past, have not submitted oil data since June 2015.

Identifying trends in participation is made more complicated by the fact that JODI lists a country as having submitted data for a particular month even if only a single data point has been submitted. There are also bright spots in submission trends. The latest JODI for gas update includes revisions and new data from Algeria, Equatorial Guinea, Libya and Ecuador, for example. But, overall, the submissions appear to have reached a plateau.

JODI’s catchphrase is "better data, better decisions". Although there is little evidence that market volatility is linked to a lack of transparency for energy data, the JODI initiative has successfully brought producers and consumers together, helping break down barriers between what had in the past been polarised groups. JODI argues comprehensive data sets facilitate strategic planning and investment decisions, and that this is important to the stability and smooth functioning of the market.

JODI retains high-level political clout. The original JODI world database was launched by King Abdullah of Saudi Arabia. The initiative gained momentum after the 2008 oil price spike; International Energy Forum ministers called for greater energy data transparency, including the extension of the JODI platform to cover natural gas.

Now the bubble in oil and gas prices has been pricked, however, the political impetus behind the data transparency initiative has waned.

JODI has taken a number of proactive initiatives to improve engagement with the data by the media and industry analysts, including improvements in its website and more interactive forums to widen awareness. There has also been discussion of extending the initiative to other energy commodities, including potentially coal and electricity, although no decision has been taken to do this.

Despite these aspirations, however, it is difficult to argue with the numbers: as oil prices have declined, so have the number of countries submitting regular data.