Traders cut short positions in oil and gas

The trading floor at BP’s hub in Houston. The upcoming meeting of oil producers is causing market jitters. (BP plc)

The trading floor at BP’s hub in Houston. The upcoming meeting of oil producers is causing market jitters. (BP plc)

Speculative traders have sharply cut their short positions in oil and gas futures in advance of the 17 April ‘emergency’ meeting of oil producers in the Qatari capital Doha.

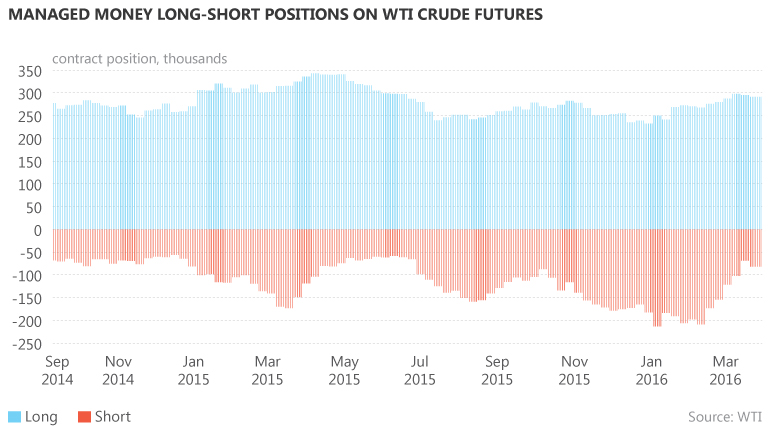

Weekly data issued by the Commodity Futures Trading Commission (CTFC) shows net short positions held by managed money – a category comprising large financial institutions, investment banks, and hedge funds – in the main oil and gas futures contracts dropped sharply in March.

On the NYMEX, WTI crude oil futures saw a rise in net length held by managed money from a January low of just 36,372 contracts to a recent high of 226,086 contracts. This was partly the result of a reduction in shorts held by managed money, from more than 200,000 contracts to around 75,000, and partly from an increase in long positions held. Meanwhile, Brent crude oil net short positions dropped from a low of 50,452 contracts earlier this year to 22,324 contracts.

Gas futures market participants also appear to have become less bearish. The net short position held by managed money in Henry Hub futures dropped from a winter low point of 233,984 contracts to 91,242 contracts.

Managed money has been net short on the Henry Hub since December 2014. The reduction in the short position is striking because demand for gas typically drops in the spring when the weather is milder.

The CFTC provides weekly data to give greater transparency on the trading positions of companies in the futures and options markets.

The CFTC expanded the weekly Commitments of Traders (COT) data after oil prices spiked at $150 per barrel in 2008 to separately reflect the long and short positions held by different market participants. The COT data now tracks the positions held by swap dealers, managed money, producers and merchants, as well as other reportables.

The CFTC data is tracked closely because the trading positions of managed money are believed to reflect the views of professional investors, the so-called ‘smart money’ in the market.

Growing caution

The reduction in the short positions held in Brent and WTI futures reflects the market’s growing caution ahead of the April meeting, which will include OPEC and non-OPEC countries.

So far, Saudi Arabia, Russia, Kuwait, Nigeria, the United Arab Emirates, Indonesia, Venezuela, Bahrain, Algeria, Oman, Ecuador and Qatar have confirmed they will participate. The next OPEC meeting is scheduled for 2 June in Vienna.

Saudi Arabia, Russia, Qatar and Venezuela agreed on 16 February to freeze their production at current levels. This caused oil futures prices to bounce to above $40/bbl from the 12-year lows reached in January of around $27.88/bbl for Brent and $26.21/bbl for WTI crude.

Since then the price has fluctuated between $33-42/bbl for Brent and $31.50-41.50/bbl for WTI front-month futures. Oil prices dropped from highs of above $110/bbl in June 2014 after Saudi Arabia abandoned its long-standing role as OPEC’s swing producer.

The kingdom has been pumping at record high levels since December 2014 because it wants to drive out what it calls "less efficient" sources of oil production, such as United States shale oil.

Industry scepticism

Analysts are generally sceptical that the Doha meeting will result in a meaningful deal given that Iran has refused to rein in production now the US and Europe have lifted sanctions against it.

Saudi Arabia said last week it would not agree to freeze production unless Iran was part of the deal. Iran’s crude oil exports were reduced by around 1 million barrels per day because of the sanctions, which were lifted in January after an agreement between Tehran and the five members of the UN Security Council plus Germany. Iran is expected to boost production by around 600,000 b/d this year now that sanctions have ended.

Oil markets have been glutted and global oil stocks are close to record highs. The International Energy Agency (IEA) estimated in its latest monthly report that OECD commercial inventories rose by 20.2 million bbl in January and said that forward demand cover remained comfortable. The IEA said preliminary figures suggest withdrawals were made from OECD inventories for the first time in a year in February, while volumes of crude held in storage on tankers increased.

Henry Hub futures prices remain mired in contango, a situation in which prompt prices are discounted to those for future delivery. The reduction in the short position may simply reflect the historically low prices rather than any overt bullish sentiment. Traders have been short-covering ahead of anticipated drops in US production later this year as a result of the decline in drilling triggered by low prices.

The May futures contract on the Henry Hub remains below $2/MMBtu after the April contract expired last week at around $1.903/MMBtu. Henry Hub front-month futures hit a low of $1.64/MMBtu in early March. Gas stocks in the US remain high. Working gas stocks for the week ending 25 March were nearly 69% higher than a year earlier and nearly 52% above five-year average levels.

Any significant rebound in oil prices could potentially boost LNG contract prices in the months ahead as around 70% of LNG worldwide is still tied to the price of oil.

However, if oil were to rise above $45/bbl, oil-indexed LNG would potentially be undercut by cargoes with prices linked to the Henry Hub, which currently land in Europe at around $5.5-6/MMBtu.

US LNG export prices typically reflect the Henry Hub price plus a liquefaction and tolling fee, while LNG sold into Europe is usually based on a formula indexed to the price of crude oil, gasoil and fuel oil.