Saudi power sector sees future in gas

Expanded gas processing capacity at Saudi Aramco. (Saudi Aramco)

Expanded gas processing capacity at Saudi Aramco. (Saudi Aramco)

Saudi Arabia is boosting the use of gas in its power sector. Gas is already the largest source of power generation in the kingdom, and Saudi policies favour an even greater use of the fuel in coming years. Declining export revenues from low oil prices are also playing a part in the growing popularity of gas-fired power in the country.

Saudi Arabia is under pressure to maximise its oil-export revenues, which means reducing the domestic consumption of oil. Oil and its derivatives have been the popular choice of feedstock in the Saudi power sector in the past, but the kingdom’s electricity landscape is changing fast. Nonetheless, the country will keep direct crude burns as a strategic option until at least 2020 as gas is unlikely to completely replace oil and its derivatives in the power mix.

Oil exports are vital to Saudi Arabia’s economic prospects, but persistent declines in oil prices since mid-2014 have strained the kingdom’s finances. The Brent crude front-month futures price has averaged $39.1 per barrel so far in March – a decline of 65% since June 2014. The International Monetary Fund expects Saudi Arabia’s GDP growth to be particularly affected by weak oil prices. Its most recent forecasts are for Saudi Arabia’s GDP to grow by 1.2% in 2016 and 1.9% in 2017 compared with previous forecasts of 2.2% and 2.9%, respectively.

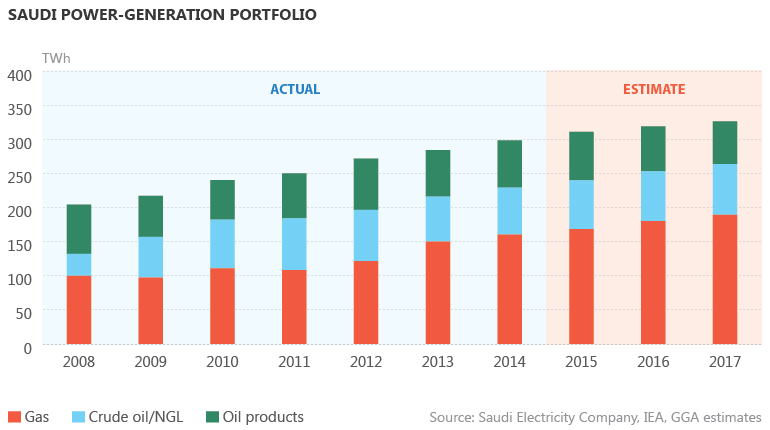

Oil and oil products accounted for 54% of power generation in Saudi Arabia in 2010, with the remainder being produced using gas. In 2015, Saudi power generation amounted to 310.7 TWh, with gas accounting for 54.2% of the figure. Gas is expected to consolidate its position in the power mix further in the coming years, and GGA expects the fuel will account for 58% of the kingdom’s electricity generation in 2017.

Gas to the rescue

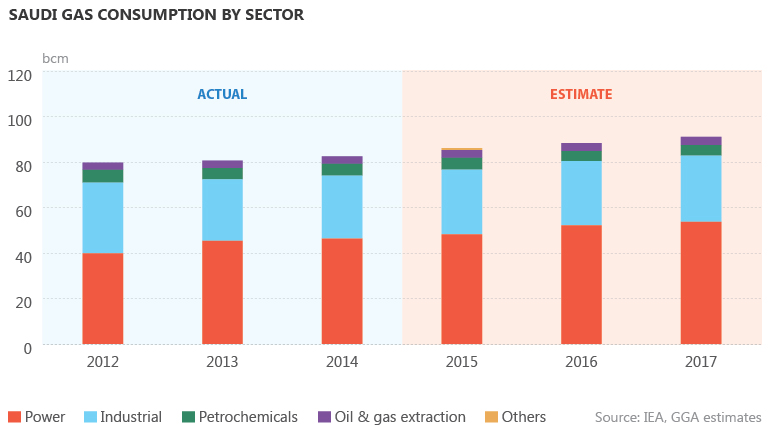

The power sector is the biggest user of gas in Saudi Arabia. Greater emphasis on gas-to-power is a deliberate move to free up more oil and oil products for exports. The kingdom has also introduced policies aimed at reducing the use of gas by other sectors so more is available for the power sector.

Gas-for-power demand in Saudi Arabia amounted to an estimated 48.2 billion cubic metres in 2015, accounting for 56% of the country’s total consumption of marketed gas. In 2010, the figure was 50%. The power sector’s share of gas consumption is set to increase further in the coming years. GGA expects power sector consumption to rise by 11.4% in 2017 compared with 2015, to 53.7 bcm – accounting for 59% of total gas demand.

Power demand is also rising in Saudi Arabia, causing electricity generation to increase by an average of 6.2% each year since 2010. Electricity demand peaks during summer, and it reached an all-time high of 62.3 GW last summer – much higher than the previous record of 56.6 GW in summer 2014.

Saudi Arabia has ambitious plans to invest in its power infrastructure in the coming years, and gas is set to play a vital role. The kingdom expects electricity demand to increase to 90 GW by 2022, and it intends to invest more than $130 billion over the next 10 years to improve electricity generation, distribution and transmission infrastructure.

Saudi Aramco and Saudi Electricity Co. (SEC) are working on installing an additional 12.8 GW of capacity by the end of 2017, of which 6.9 GW will be gas-fired. Some of the key gas-fired projects being developed include the integrated power projects (IPPs) at Duba and Rabigh, as well as projects at Durma and Riyadh. Aramco and the SEC have been raising funds for these projects in the financial markets. The SEC has raised more than $30 billion since it issued its first sukuk – an Islamic bond – in 2007, part of which is being used for power generation projects.

Direct crude burns will remain a strategic option for power plants in Saudi Arabia despite the growing popularity of gas, however. The kingdom is not producing enough gas to meet electricity demand, especially during summer. Consequently, almost 46% of the proposed capacity additions by the end of 2017 will still burn crude oil.

Saudi utilities are also taking steps to improve the efficiency of power plants. Several generators are already upgrading existing open-cycle oil and gas plants to the combined-cycle mode, which could improve efficiency by as much as 50%. The SEC and Saudi Arabia’s Electricity and Cogeneration Regulatory Authority have jointly commissioned a study on electricity end-use efficiency, which is due for completion in September.

Subsidy reforms to support gas-for-power

Saudi Arabia’s recent subsidy reforms will also increase the appetite for gas from the country’s power sector. The reforms are aimed at reducing the use of oil products in the power-generation mix, but they will also dampen the use of gas by sectors such as the petrochemicals industry.

The kingdom increased feedstock prices to the power and petrochemical sectors from January 2016. The price of diesel to power plants was increased to $2.18/MMBtu from $0.67/MMBtu, while the price of heavy fuel oil was lifted to $0.86/MMBtu from $0.43/MMBtu. The diesel price hike is already supporting gas-for-power demand. In February, the SEC ordered six 30 MW trailer-mounted gas turbines for use at existing power plants in Jazan and Tabuk, replacing diesel-fired generators.

Reduced electricity subsidies will improve the finances of the SEC and boost investment in power infrastructure. The company collected less than $0.04/kWh on average from consumers in 2014, around 10% below the average generating cost. The revised electricity tariffs will now see residential, commercial and industrial customers paying $0.01/kWh, $0.04/kWh and $0.05/kWh, respectively. The new tariffs aim to allow the SEC to recover at least the full cost of its power generation.

The reforms have also increased the price paid for gas by power utilities to $1.25/MMBtu from $0.75/MMBtu. The increase is intended to encourage upstream investment and goes hand-in-hand with the kingdom’s plans to boost non-associated gas production. The move will allow upstream producers to recover a higher price for their gas.

Saudi Arabia is focusing on developing its non-associated gas acreage in a bid to meet its growing gas demand. Almost 70% of Saudi Arabia’s gas production comes from associated fields, which limits its flexibility to boost output at short notice. Consequently, the country is developing non-associated gas projects such as Midyan, Wasit and Fadhili.

The Wasit project is expected to start commercial gas production before the peak-summer demand period this year. Aramco commissioned a key processing unit of the project in February. Meanwhile, Midyan is expected to start commercial gas production by late 2016, followed by Fadhili in 2019.

The subsidy reforms will also dampen gas consumption by Saudi Arabia’s petrochemical industries, freeing up more gas for the power sector. The petrochemical sector will now pay $1.25/MMBtu for gas feedstock, up from the previous $0.75/MMBtu, while the price of ethane feedstock has increased from $0.75/MMBtu to $1.75/MMBtu. Meanwhile, higher electricity prices for industrial customers will add to the challenges faced by Saudi petrochemical producers.

Low oil and petrochemical prices are already hurting the profits of the Saudi petrochemical sector. The sector’s net profit was $5.67 billion in 2015 – a fall of 37.9% on an annual basis. Saudi Arabia’s petrochemical industry was moving away from gas even before the subsidy reforms, but the reforms will further reduce the industry’s reliance on gas (see GCC fertiliser industry drifting away from gas, November 2015). GGA expects gas demand by the Saudi petrochemical sector will decline by 11.6% in 2017 compared with 2015 – to 4.6 bcm.

Solar rising slowly

Saudi Arabia plans to introduce commercial solar power generation into its fuel mix, but progress has been slow. Gas will still serve as a backup fuel even for the proposed solar projects.

The 610 MW Duba 1 integrated solar combined-cycle (ISCC) project, scheduled for completion in 2017, will have 50 MW of solar-power generation capacity. The SEC is also developing another ISCC project at Waad al-Shamal that is expected to come online in 2018. The project will have a capacity of 1.39 GW, but only 50 MW of this will be solar powered.

The SEC has also requested technical proposals for the 3.78 GW ISCC project at Taiba. No completion timeframe has been provided, but the project will have 180 MW of solar capacity. Renewables are unlikely to be a significant contributor to Saudi Arabia’s power-generation mix by 2020.

Gas will consolidate its position in Saudi Arabia’s power-generation portfolio in the coming years. Financial strains resulting from low oil prices, the current subsidy policy, and development of non-associated gas acreage are all favourable to greater gas use in the country’s power sector. Crude oil will remain a vital part of the country’s power-generation mix in the coming years, supplementing gas during peak-demand periods. However, this will not prevent gas consolidating its position further in the power sector.