Anti-fracking protesters outside North Yorkshire County Hall, Northallerton, on Friday. (PA)

Anti-fracking protesters outside North Yorkshire County Hall, Northallerton, on Friday. (PA)

Efforts by UK shale explorer Third Energy to frack a well in North Yorkshire have been stymied by local residents – a scenario that has become all too familiar for the country’s other shale hopefuls.

Councillors at North Yorkshire County Council gathered in Northallerton on Friday to debate Third Energy’s application to frack a well site at Kirby Misperton.

The hearing is expected to continue until Monday, when councillors are expected to decide whether to approve the application.

Third Energy, the majority of which is owned by Barclays bank, applied for a fracking licence at its Kirby Misperton site in May last year and received a positive recommendation from the county planning officer to approve the well on 12 May.

There is significant opposition among North Yorkshire residents to Third Energy’s plan to drill in the area. Residents argue it would set a precedent, opening the door for hundreds more wells needed for the commercial production of shale.

"Fracking would mean an unacceptable industrialisation of a rural area, devastating effects on the rural nature and have a negative impact on tourism," residents told the council on Friday morning.

Local resident John Ashton, a former special representative for climate change for the UK government, said fracking will undermine the UK’s climate change policies and that no more domestic production of gas is needed.

"We have an energy investment problem, not an energy security problem. This is merely speculative opportunism by those that think they can make money from [fracking]" Ashton told the council on Friday morning.

If the council refuses to grant permission, Third Energy would be able to appeal against the decision in the same way as Cuadrilla Resources, which locked horns with Lancashire County Council (LCC) earlier this year.

LCC refused to grant Cuadrilla fracking rights for two sites in the county, so the matter has been referred to Secretary of State for Local Government Greg Clark, who is expected to make the final decision by 4 July.

Clark is likely to be supportive of Cuadrilla’s plans given Westminster has promised to go all out for shale and continues to back the industry, despite local opposition.

"Shale is a fantastic opportunity for the UK," energy minister Andrea Leadsom said on Wednesday, adding that government and industry are both "eager to press forward".

Financial distress

But even if the government eventually approves the plans, opposition from local authorities has cost companies precious time, while falling oil prices and an oversupplied market have put many industry players under increasing financial pressure.

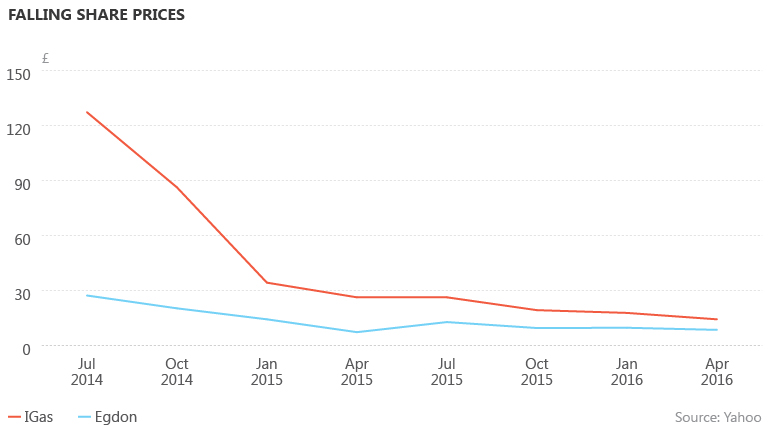

While many of the UK’s leading shale explorers are privately owned – including Aussie-backed fracker Cuadrilla – two of the publicly traded shale gas pioneers have seen their share prices crash over the past two years.

Shares in UK producer IGas have fallen from £140 in 2014 to less than £15 in May, while shares in Egdon Resources fell by 65% over the period, trading at £8.80 on Thursday.

Privately held Swiss chemical giant Ineos has emerged as one of the most important players in the UK over the past few years.

"Its role cannot be underestimated. Ineos is arguably far more important than the exploration companies – who will be driving the exploitation for shale in this country," said Dan Lewis, energy adviser at the Institute of Directors.

As a major petrochemicals company, Ineos is keen to exploit shale and especially NGLs such as ethane, which the company imports from the United States. Ineos signed a 15-year contract to import ethane in 2012. In March 2015, Ineos also agreed to pay IGas £30 million in cash and fund a work programme of up to £138 million to appraise and develop shale sites.

However, gas production is still a few years off for Ineos, which is in the early exploration stage. The company plans to acquire 2D and 3D seismic data in 2016 and 2017 and drill vertical coring wells across its three regional licence blocks in England to gain a better geological understanding of the area.

"Once this information has been analysed, assuming it is positive, we will look to drill and frack horizontal wells at a number of locations in order to flow test the wells," the company’s spokesperson told Interfax Natural Gas Daily.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].