Henry Hub linkage could stabilise gas-to-power

The advent of LNG exports from the US offers a window of opportunity for buyers looking for a stable gas price. (Cheniere Energy)

The advent of LNG exports from the US offers a window of opportunity for buyers looking for a stable gas price. (Cheniere Energy)

Gas-to-power projects look set to boost LNG demand. Using the Henry Hub as a pricing reference may offer buyers a less risky alternative to oil indexation.

A typical gas-to-power project involves a sales and purchase agreement (SPA) between the gas supplier and LNG importer, a separate downstream gas supply agreement between the LNG importer and the end-user of the regasified natural gas, and one or more power-purchase agreements (PPAs) between the power generator and the electricity purchaser.

Each party in the value chain is exposed to risk because the terms negotiated for the imported LNG may not match the terms for the supply of downstream gas, and the gas price may not move in tandem with the electricity price.

With the LNG and oil market likely to move from surplus to tightness over the next decade, the choice of a suitable pricing reference will be critical for the success of gas-to-power projects.

Natural gas and LNG contracts typically reference oil prices (crude oil, diesel and heavy fuel oil) or the price at trading hubs far from the countries where the gas is actually consumed. When the price of electricity is fixed or tied to inflation indices such as the Consumer Price Index, there is a risk changes in the price of gas feedstock used in power generation will not be able to be passed on to customers. Regulation of electricity prices in downstream markets and the existence of subsidies on domestic gas prices may compound the risks.

Prices diverge

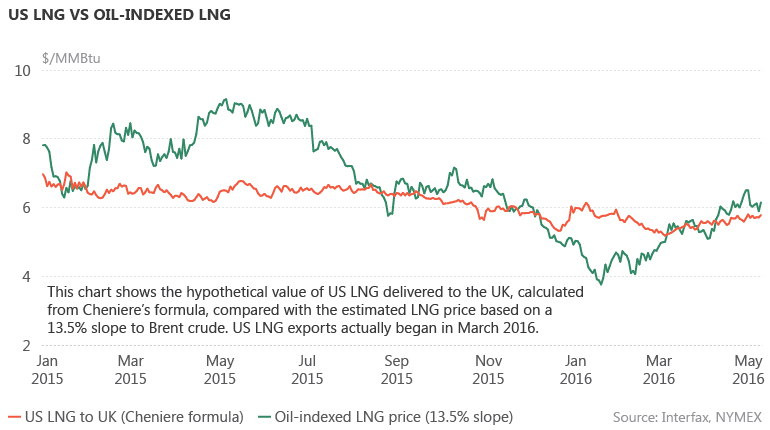

Gas typically competes in the power sector with coal and oil products, such as diesel and heavy fuel oil. In the past, the indexation of the gas price to oil prices has meant a strong rally in the oil price is followed by a commensurate rise in gas contract prices, usually with a few months’ lag. However, with the advent of LNG exports from the United States tied to Henry Hub prices, the traditional relationship between the two fuels is breaking down.

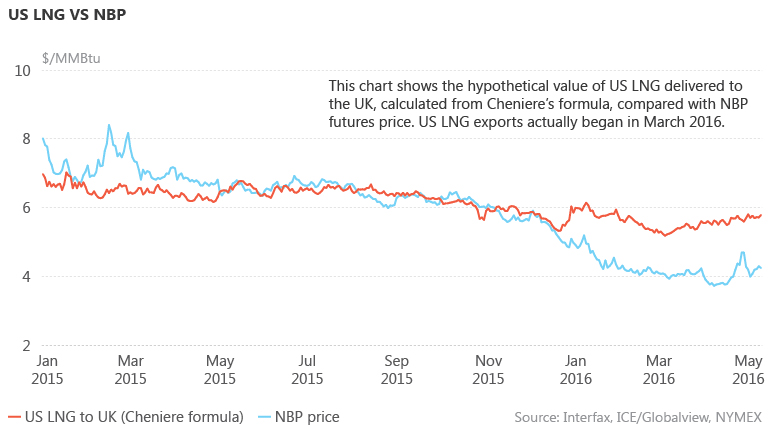

Because US LNG is not indexed to oil prices, it could potentially act as a cap for spot prices if oil prices recover. This would further widen the gap between oil and gas prices, putting pressure on suppliers to offer more flexible terms to contract holders.

ICE Brent futures have rallied from lows of less than $27 per barrel in January to recent peaks of around $48/bbl. In contrast, gas prices remain depressed because of surplus LNG from export plants in Asia and the US. A mild winter, which has left consumers with comfortable storage levels at the end of the peak consumption period, has also weighed on gas prices.

Gas and LNG prices have hit their lowest levels in many years. Delivered ex-ship spot prices in China and Japan have dropped from record highs of more than $20/MMBtu in 2013 to around $7/MMBtu at the start of this year, and they are currently around $4.25/MMBtu. Although a hot summer in the Middle East and northern Asia could reverse the downtrend in LNG prices, any upside would be limited given the new supplies due from large Australian liquefaction projects such as Gorgon LNG.

Conversely, the oil market is gradually rebalancing. US crude oil production has fallen below 9 million barrels per day (MMb/d) as the price slump hits shale producers, driving many of them out of business. Oil consumption is growing by 1.2-1.3 MMb/d each year because of continued strong demand growth for liquid fuels in Asia.

Meanwhile, exploration budgets have been cut because of the price slump, making it unlikely that oil will be found in sufficient quantity to offset annual field declines of 2-8%. A four-decade-old ban on exports of crude oil from the US was lifted last year, so any recovery in world oil prices would quickly filter through into improved shale oil prices.

Although more than two-thirds of the world’s LNG is still indexed to oil prices, US LNG exports are tied to the price at the Henry Hub in Louisiana, which dropped to as low as $1.47/MMBtu in March on a spot basis. LNG export capacity from the US is set to hit 70-75 mtpa by the end of this decade, with much of the output going to portfolio players active in the spot market.