Mozambique may have to wait until 2021 for its ship to come in. (Anadarko)

Mozambique may have to wait until 2021 for its ship to come in. (Anadarko)

The Resource Curse is a much talked-about phenomenon, but what about the ‘presource curse’ – when a country’s economy is derailed not by resource exports, but the mere prospect of them?

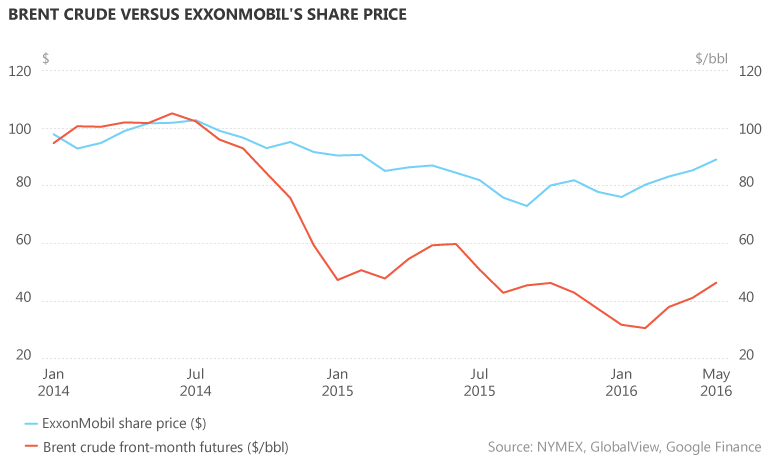

Mozambique is the latest country to fall victim to this ill. The government took out more than $2 billion in secret, state-backed loans in 2013 and 2014 on the assumption they would be easy to repay once gas revenues from its giant Rovuma Basin LNG projects started flowing in 2018. But that date always looked optimistic: now, after the oil price collapse, even a 2021 startup – when the largest of the debt repayments is due – looks unlikely. With the government broke and at real risk of a sovereign default, the FIDs could be pushed back further still.

The impact of this reckless borrowing is that when the revenues finally start flowing they will initially be spent servicing debt rather than developing and diversifying the economy, and the government’s weak bargaining position means the size of the revenues over the whole life of the project could be seriously reduced. The greater political and financial risk Mozambique now poses means it will almost certainly be more expensive to raise financing for the project. The crisis could also raises questions over long-term contract stability.

"If the government finds itself in serious debt repayment problems, would they revoke contracts or demand new terms? These are elements that could make the investors demand greater protection or revenues," said Sam Jones, a Mozambique expert and associate professor of economics at the University of Copenhagen.

Investors could use the government’s need to close the project quickly to extract more favourable terms on issues such as the domestic gas obligation volume and price, or – the major concern – "that the government concedes large tax breaks (or equivalent) to get projects moving", said Jones. Mozambique’s weaker credit rating will mean raising debt for any project – not just gas – will be more expensive, harming the government’s plans for diversified economic development through tourism, electricity, agriculture and infrastructure.

The over-valuation of the metical in recent years – partly fuelled by anticipation of a gas boom and, in hindsight, partly by the hidden debt – has already hurt development of some of these sectors. They are likely to take another hit from the now unavoidable budget cuts.

Of course, Mozambique is not the only country to be suffering under the curse. Any country where governance is weak can fall prey to the phenomenon. "If the discovery of high-value natural resources precedes the development of strong institutions and the rule of law, what follows is usually a complex mix of arbitrary policymaking, cronyism and poor deals," said Titus Gwemende, Oxfam’s southern Africa regional adviser on extractive industries.

Brazil and Ghana, for example, are both arguably cases where elevated expectations of oil returns led to macroeconomic recklessness. But Tanzania is perhaps an interesting counter-example.

"Like Mozambique, Tanzania has been planning LNG investments for years. Unlike Mozambique, it looks more certain to miss out on these altogether. Tanzania didn’t go as far down the investment path as Mozambique or Ghana, and perhaps as a consequence didn’t get into any deep fiscal problems either," said Jim Cust, director of research and data at the Natural Resource Governance Institute. "It’s hard to prove the counter-factual, but they just got a ringing endorsement from the International Monetary Fund on the state of the economy."

So while Mozambique may beat its northern neighbour in the race to export LNG from East Africa, Tanzania could be the real economic winner in the long term. "Time will tell, but looking at Ghana and now Mozambique, it’s not hard to think Tanzania might have dodged a ‘resource’ bullet, in the short run at least," said Cust. LE

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].