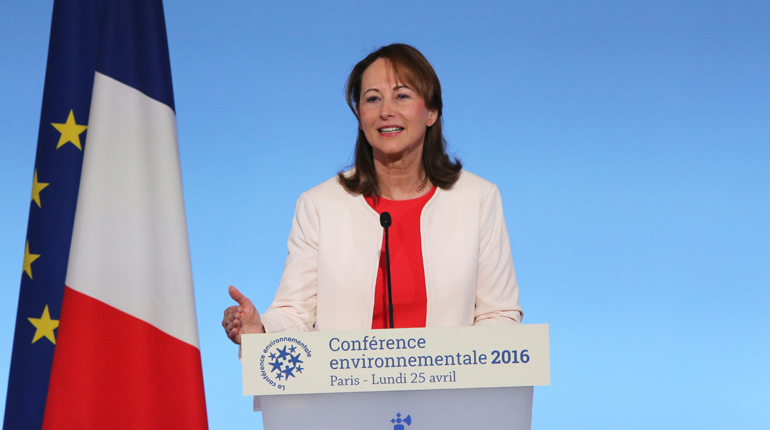

French Energy Minister Ségolène Royal has proposed a ban on shale gas imports from the US. (PA)

French Energy Minister Ségolène Royal has proposed a ban on shale gas imports from the US. (PA)

French energy minister Ségolène Royal shocked industry players on Tuesday when she said France is investigating options to ban shale gas imports from the United States.

However, this would be against both World Trade Organization (WTO) and EU law, experts told Interfax Natural Gas Daily.

"I’m going to examine legally how we can prohibit the import of shale gas, and in any case [in the long run], these businesses will have to shift towards other markets to import only conventional gas," Royal said.

This is bad news for US shale gas exporters such as Cheniere, which plans to sell up to 50 LNG cargoes to France’s EDF until 2018 from its Sabine Pass facility to the delayed Dunkirk terminal, following deals agreed in August and September 2015.

French utility Engie also signed a five-year sales and purchase agreement with Cheniere to purchase up to 12 cargoes of LNG per year to be delivered ex-ship at the Montoir-de-Bretagne terminal.

"I have asked the two companies why they weren’t vigilant, and I have also asked for an examination of a legal means for us to ban the import of shale gas," Royal said. France banned shale gas exploration in 2011, citing environmental concerns.

A Cheniere representative attending the Flame conference in Amsterdam did not want to comment on Royal’s statement at length, but said the proposed ban was "absolutely stupid".

Legal experts agree an import ban would likely raise significant concerns under both EU and WTO law. According to Charles Julien, counsel at King & Spalding’s international trade practice group, the EU’s trade and investment policy is the exclusive competence of the European Commission.

"The authority of France to impose a ban on a national scale could be questioned. Only the EU can act in areas where it has exclusive competence," Julien said.

GATT discrimination

Alan Dunn, a Washington-based trade attorney with the law firm Stewart and Stewart, said that applying a restriction solely to US imports also appeared "to be a prima facie case of discrimination in violation of General Agreement on Tariffs and Trade (GATT) Article XIII".

Environmental concerns offer a possible exemption under GATT, but they are hard to prove in practice. "The burden of proof is quite high for the party claiming [exemption because of environmental concerns]," Dunn said.

Gary Clyde Hufbauer, senior fellow at the Peterson Institute for International Economics, agreed.

"This is nuts. I don’t see how France could persuade the other EU members to go along with this silly idea," he told Interfax Natural Gas Daily.

The announcement runs counter to the EU’s strategy of supply diversification, which stresses the need for US LNG.

Industry experts said Royal’s comment lacked a fundamental understanding of the global energy trade. Physical gas molecules cannot be separated according to origin and France has interconnections with other European countries importing LNG, Andy Flower, an independent LNG consultant, told Interfax Natural Gas Daily at the Flame conference on Thursday.

For example, France has an interconnection with the UK, which also imports LNG and domestically supports shale gas exploration.

"Usually, the political interests behind calls for trade restrictions are well ahead of the legal foundations for such measures. And in many cases, the legal failings of such proposals are irrelevant because simply making the proposal is enough to serve the intended political ends," Dunn added.

Experts said US LNG importers will struggle to ship gas to Europe at competitive prices without making a loss given the glutted market. US LNG lands in Europe at around $6.2/MMBtu at the current Henry Hub front-month futures price, while Russian gas delivered via the Nord Stream pipeline reaches Europe at $4.00/MMBtu, according to the Oxford Institute for Energy Studies.

But the call for a ban exemplifies the increased risk major fossil fuel investments could face from stricter environmental regulation – and this is not the only regulatory uncertainty faced by US shale.

Teddy Kott, head of global gas analysis for EDF Trading, said regulatory changes in the US are "something worth watching [...] It is not a zero possibility that there is a backlash against drilling onshore in the US," he said at the Flame conference on Thursday.

Green pressure group the Sierra Club opposes fracking in the US and legally challenged the US Department of Energy’s authorisation process for terminals such as Sabine Pass.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].