Summary

Spot LNG prices in Northeast Asia and Latin America have fallen, while European hub prices are likely to see temporary support from an unseasonable cold snap.

Forecast highlights

- Spot LNG prices in Northeast Asia have recovered slightly from the lows of $4/MMBtu seen in early April. Although hotter than average temperatures could hit the region during the northern hemisphere summer, support for prices will be limited.

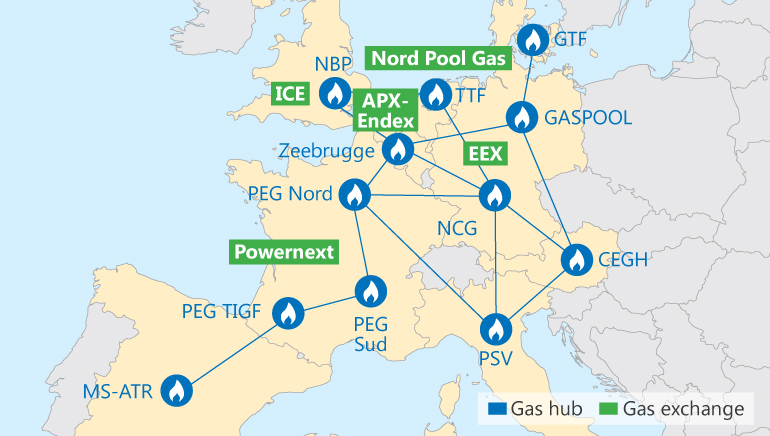

- European hub prices have steadily declined over the past few months, with the NBP month-ahead averaging around 27 p/th in mid April. Increasing volumes of piped and LNG imports will keep prices under pressure through the spring.

- Pressure on gas prices in Western Canada is expected to intensify in the next few months because of falling demand and improving storage levels. This is widening the difference between the Dawn and AECO hub prices.

- The Henry Hub front-month futures price is expected to receive support as gas-to-power consumption gathers pace moving into the summer. The prospect of a year-on-year decline in US gas production this year will also boost the price in H2. However, improving gas storage levels during the injection season will limit price gains.

- The price of spot LNG in Latin America is facing a bearish market during southern hemisphere winter. Falling demand in the region and an oversupplied market will add to the pressure on the spot price.

- Double-digit LNG import growth rates are expected in the Middle East and Africa, helped by low regional spot prices. The low price is also prompting regional suppliers such as Qatar to offer flexible short- and medium-term volumes.

- Global oil prices are expected to receive support in the coming months as anticipation mounts that the oil market will start to rebalance in H2. June’s OPEC meeting will be closely watched, especially after Iran said it expects to reach its pre-sanctions production level by June.