A rig at the In Salah field. The project suffered a rocket attack in March. (Jon Gaute Espevold/Statoil)

A rig at the In Salah field. The project suffered a rocket attack in March. (Jon Gaute Espevold/Statoil)

Algerian NOC Sonatrach is holding "secret negotiations" with BP and Statoil regarding the In Amenas gas plant, a senior Algerian economist has told Interfax Natural Gas Daily.

Abderrahmane Mebtoul, a university professor who has been advising the Algerian government on energy matters since the 1970s, said the talks signalled a clear intention by Algiers to attract more business to the gas-rich country.

"Sonatrach is looking at relaxing its terms of doing business with IOCs to attract more companies and to retain those that are already here," said Mebtoul.

Contracts signed from 2013 onwards require Sonatrach to hold a 51% stake in all exploration and extraction licences in the country. A windfall tax also kicks in on profit margins when Brent trades above $30 per barrel.

While the In Amenas contract was negotiated before these changes, BP and Statoil are still facing cost pressures because of the size of the plant, the challenging price environment and production costs.

"At the end of the day all that matters for any IOC is how much money they can make in any given country, and with low oil prices exerting pressure on balance sheets, they need to make decisions on where to invest," said Mebtoul.

He added Algeria was facing pressure to renegotiate deals not only from IOCs, but also from European customers that will likely be looking for price discounts when they renew their gas contracts this year.

Whether it is the result of contract negotiations, staff evacuation or engineering issues, it is unclear when the third train at In Amenas will restart.

Train 3 was damaged during an attack in 2013 that claimed 40 lives, and it has yet to start up. News reports claimed the train would come online in April, but a Statoil spokesperson told Interfax Natural Gas Daily on 19 April that the train is scheduled to open "within the next months".

Slow return

Scott Dean, deputy head of the BP group press office, told Interfax Natural Gas Daily that Train 3 was scheduled to come onstream before completion of the compression project in Q3 2016. BP has revealed a "limited number of [previously evacuated] staff" are now back in Algeria following the rocket attack at the In Salah plant in March.

"After a detailed assessment of the situation and close collaboration with our partners Sonatrach and Statoil, a limited number of staff are returning to Algeria to support joint venture operations, joining those who have remained in the country throughout," the company said.

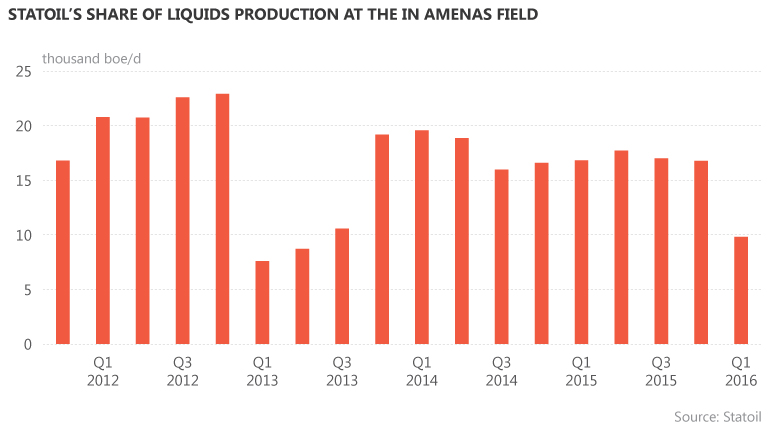

While Statoil spokesperson Knut Rostad said the temporary relocation of staff had not affected operations at In Amenas, a 40% drop in production was recorded in Q1 2016. He attributed this to maintenance issues, which led to the shutdown of the plant from mid-February to the third week in March.

"We will continuously adapt the manning of the security situation and contribute to an efficient production – from other locations or at the facilities," Rostad added.

Finance not safety

Mebtoul said that the temporary exit of IOCs from Algeria has more to do with company balance sheets than security threats.

He added Algeria is safer than other countries in which IOCs have kept their workers, such as Nigeria and Iraq. In comparison to these countries, however, he believes that IOCs may be earning 10-15% less in Algeria. This makes gas extraction unattractive to new players and renegotiable for those already active in the country.

Mebtoul estimates that it costs $4-5/MMBtu to deliver Algerian gas to market, excluding the additional security measures recently introduced at the IOCs’ sites. These cost around $1-2/MMBtu and are being covered by the state, he said.

Hydrocarbons represent more than 90% of Algeria’s exports. But according to Mebtoul’s analysis of a recent International Monetary Fund report, the price of Brent crude would need to average $87/bbl this year for Algeria to be able to balance its books.

This has led Sonatrach to invest in enhanced oil and gas recovery projects and, according to Reuters, to attract IOCs by negotiating exploration terms directly instead of going through other state bodies. However, IOCs have shown little interest in Algeria in recent years.

"Algerian gas is expensive to extract, which is reflected in LNG prices, and the fiscal regime is quite onerous on companies, especially for the smaller fields," said Mebtoul.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].