Brazil’s Euzebio Rocha gas power plant. The country’s deepening recession is harming the sector. (Petrobras)

Brazil’s Euzebio Rocha gas power plant. The country’s deepening recession is harming the sector. (Petrobras)

Brazil’s recession could delay construction in the country’s gas-to-power sector by years, Rio de Janeiro-based experts have told Interfax Natural Gas Daily. Brazil’s giant tender for future power projects flopped last week, with only 10% of available electricity capacity sold.

"Electricity demand will be low for several years, so there is no logic for large-scale power projects, including gas-to-power," a Rio de Janeiro-based source from a major utility, who wanted to remain anonymous, told Interfax Natural Gas Daily on Wednesday.

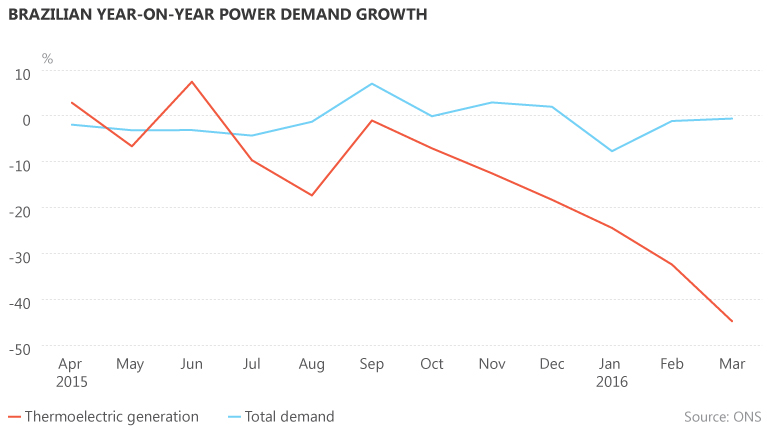

Brazilian power demand fell by 3.2% in Q1 2016 year on year, according to data from ONS, Brazil’s transmission system operator. Thermoelectric generation fell by more than 34% during the same period.

Roberto D’Araujo, director of the Rio de Janeiro-based Ilumina Institute for the Strategic Development of the Energy Sector, told Interfax Natural Gas Daily there were two reasons why Brazil’s power consumption has stagnated since July 2014.

"Firstly, the economy is in a deep recession, and secondly, the price of energy is much higher than in the past," he said.

Brazil’s GDP shrank by 5.9% on an annual basis in Q4 2015 – its seventh consecutive quarter of contraction. GDP declined by 3.8% for 2015 as a whole, and it is expected to shrink by a similar proportion in 2016.

D’Araujo warned there was a risk of insufficient capacity when the Brazilian economy recovers. "On the one hand, there is a sensation of a ‘surplus’ of energy. But on the other hand, there [could be] an over-evaluation of real, firm energy capacity," he said.

Brazil’s distributors bought 49.2 TWh of power production from 29 facilities in the country’s so-called ‘A-5’ auction, which was held on Friday. The auction tendered for power projects that will come online in 2021. The average price of contracted energy was BRL 198.59/MWh ($56.06/MWh).

The power plants represented just 201.8 MW of installed capacity, industry regulator ANEEL told Interfax Natural Gas Daily on Wednesday. Over 800 projects, amounting to almost 30 GW, were registered for the auction, according to ANEEL.

Slim pickings

A combined-cycle plant of just 3.3 MW was the only gas-to-power facility to be contracted from nine that were originally tendered, said ANEEL. Seven biomass plants amounting to 81.5 MW of capacity in the states of Goiás, Maranhão, Mato Grosso do Sul, Minas Gerais and São Paulo were the only other thermoelectric facilities contracted.

D’Araujo said there were also concerns about supply to Brazil’s existing gas-to-power plants. "I don’t know if Brazil will have the necessary amount of gas to meet power sector demand. More imports could be the answer, but it is difficult to say."

Executives told conference delegates in Rio de Janeiro earlier this year that the expansion of the power sector in Brazil was mainly dependent on economic growth.

However, the unpredictability of gas demand from Brazil’s power sector is a financial risk. Demand from the sector fluctuates throughout the year according to rainfall, which means the country generally buys LNG on spot and short-term contracts.

Brazil’s LNG imports are theoretically lower in Q4 and Q1 because wetter weather replenishes hydroelectric reservoirs, although the country has suffered droughts over the past three years.

"The whole system was designed around the operations of hydropower facilities, rather than for an energy system that lacks storage, production and frequently resorts to the spot market – despite having huge demand," Nelson F. Almeida, managing director of marine logistics company McQuilling Brasil Serviços Marítimos, told Interfax Natural Gas Daily earlier this year.

Brazil’s gas demand decreased by 11.4% for the first two months of 2016 compared with the same period last year. Demand from industry and the power sector slipped by 8.4% and 17% respectively.

Although the weak economy is the main factor in the reduced demand, Brazil’s gas-to-power demand is currently only moderate because summer rains have replenished water levels at the country’s hydroelectric dams.

Brazil’s average monthly thermoelectric production has been 8.34 TWh so far in 2016, nearly 2 TWh lower than the levels seen in 2014-2015.

Brazil’s gas supply has fallen by 9.4% in the same period. The country’s gas production has remained stable compared with last year, but the volume of gas reinjected has increased by over 23%, to nearly 30 million cubic metres per day. Associated gas output from Brazil’s huge pre-salt formation is increasing, but the country lacks the pipeline infrastructure to transport the gas to market.

Gas-to-power projects will also have to compete with a growing renewables sector, said D’Araujo. "Depending on the government’s policies for solar energy, thermal projects may have a serious contender, as distributed generation has fantastic potential," he said.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].