Oil price drop could spur Italian reverse flows

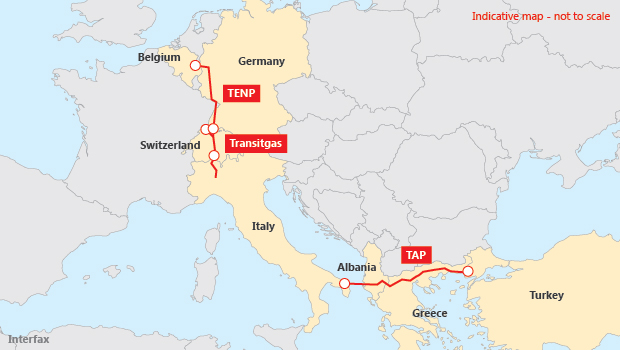

Fluxys plans to make the TENP and Transitgas pipelines bidirectional.

Fluxys plans to make the TENP and Transitgas pipelines bidirectional.

The falling oil price will show the rationale behind the expansion of reverse-flow capacity across Europe in the next few months, analysts have told Interfax. The drop in oil means oil-linked gas is now more competitive against hub-linked prices, and can be traded at a premium at northern European hubs.

Take Belgium’s TTF, for example. In January, transmission system operator Fluxys took the FID to make Switzerland’s Transitgas pipeline and the German Trans-Europa Naturgas Pipeline (TENP) bidirectional. This will make it possible to transmit gas from Italy through Switzerland to Germany, Belgium and France, as well as between Germany and France, from summer 2018.

The current price scenario could provide an additional incentive for reverse flows on this route, according to Nick Perry, senior adviser at Timera Energy.

“With the collapse in oil prices, the contract price of some oil-indexed long-term gas contracts, perhaps including some Italian imports, may fall below the TTF spot price this year,” Perry told Interfax.

“This demonstrates how, in some market conditions, there can be an economic driver to operate the reverse flow, now or in future – particularly if the Italian PSV market remains illiquid,” Perry added. When the bidirectional capacity is up and running, the incentive would be to take oil-linked volumes delivered into Europe from Russia or Algeria and sell them on northern European exchanges at spot prices.

As the PSV is generally less liquid than the TTF in practical terms, the best arbitrage for any very cheap long-term contract gas in Italy would be via the TTF – i.e., via the reverse flow.

One direction

The only infrastructure projects in northwest Europe currently capable of flowing gas in both directions are the UK Interconnector pipeline and Belgium’s network. TENP, Transitgas and Italy’s network can only carry gas from north to south at the moment.

According to the latest Energy Information Administration forecasts, Brent crude oil prices will average $58 per barrel in 2015 and $75/bbl in 2016. Following the oil price decline, prices for oil-indexed gas will fall.

Most oil-indexed gas contracts have a significant pricing time lag, however; under a typical German contract the price paid by importers changes only once a quarter, according to Nigel Harris, director and principal consultant at Kingston Energy Consulting. The Q1 2015 price is therefore based on the average of oil prices across Q2 and Q3 2014, which fell by only 3% compared with the previous indexation period (Q1 and Q2 2014).

“However, under this contract formula, a further price drop of around 16% is already guaranteed to kick in in April 2015, and if oil prices remain where they are now for the next few weeks, the oil-indexed price of gas could fall by another 30% at the next quarterly price change in July 2015,” Harris said.

South-north reverse flow could, in any case, enhance market liquidity and further align European gas prices by integrating the main European hubs, according to European Network of Transmission System Operators for Gas.

“If market appetite for south-to-north capacity picks up, investments can be scaled up progressively to also include capacity into the Gaspool market area in Germany and into Belgium; the latter would create access to the UK as well, hence connecting the three largest European markets,” Fluxys said in its statement announcing the FID.

Italian gas transmission system operator Snam has already started investing in Italy’s network to enable south-to-north flows at the Swiss border at Passo Gries.

Snam plans to export more than 5 million cubic metres per day (MMcm/d) to northern Europe at Passo Gries, and 18 MMcm/d at Tarvisio on the Austrian-Italian border.

According to a Snam spokesman, the company plans to expand the export capacity at Passo Gries after 2017 to send up to 40 MMcm/d to northern Europe through the interconnector with Austria. The reverse-flow interconnection between Italy and Switzerland at Passo Gries is listed as a Project of Common Interest by the EU.

Turning on the TAP

Besides possible price incentives, the reverse links could also further increase diversification of supplies via TAP, potentially bringing Azerbaijani gas to Italy.

“The TENP and Transitgas bidirectional investments would create south-to-north capacity and thus make gas landing in Italy available to northwest Europe, as well as flows from Azerbaijan through the Southern Gas Corridor,” Dirk Goebels, from Fluxys, told Interfax in July.

The Shah Deniz 2 project in the Caspian Sea will deliver 10 bcm/y via the Trans-Anatolian Pipeline to the Greek-Turkish border, while the Trans-Adriatic Pipeline would cross northern Greece, Albania and the Adriatic Sea before connecting to the Italian gas network.