What to expect in 2015

Posted 19 January 2015Council of EU

Interfax

Höegh

PA

PA

CNW Group/Pacific Rubiales

Polskie LNG

Yantai Jereh Oilfield Services Group

BG Group

Gazprom/Interfax

Roy Luck/Flickr

PA

PA

Transformation complete: Indonesia's new Arun LNG terminal is expected online in early 2015, after being converted from a liquefaction plant – the only such project in the world. The Arun plant came online in 1978 with three trains, and was expanded to six trains in 1986. Its production peaked in 1994 – when it exported 16.2 mtpa – but reserves have gradually run out, and the plant shipped its last cargo in October.

Back to the table: The European Commission's Energy Union vice president headed back to Moscow last week to talk about about Russian gas exports to Ukraine after the current agreement expires on 31 March. The deal reached on 31 October stabilised the situation temporarily, but there is still uncertainty. Russia further fuelled the uncertainty during the meeting, announcing it plans to re-route the gas it sends Europe via Ukraine through the new 'Turkish Stream'.

Record-setting time: Pakistan's Engro expects to bring the country's first LNG terminal online in February, making it the fastest completion in the world in less than 10 months. The group is chartering an FSRU from Excelerate Energy, with a capacity to import 3.5 mtpa. However, supply remains uncertain, as Pakistan has yet to finalise an agreement signed with Qatar, or new deals with other buyers.

Almost there: Egypt's LNG imports are also in reach, but its negotiations with Gazprom hit a roadblock as the oil price slump pulled LNG prices down. A Russian delegation planned to go to Egypt in January to finalise a deal, which follows an initial agreement to deliver 35 cargoes over the next five years. Meanwhile, Höegh's Gallant FSRU (pictured) is due to be installed at the beginning of Q2 and will receive six cargoes from Sonatrach between April and September.

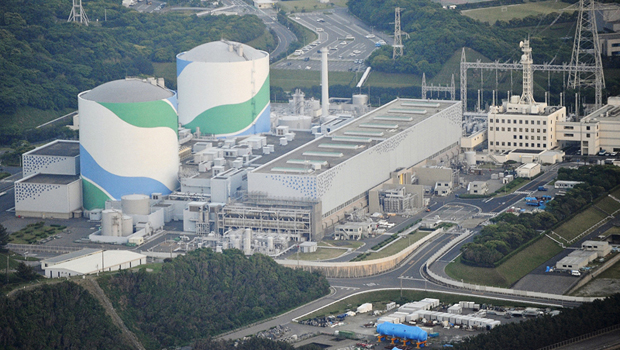

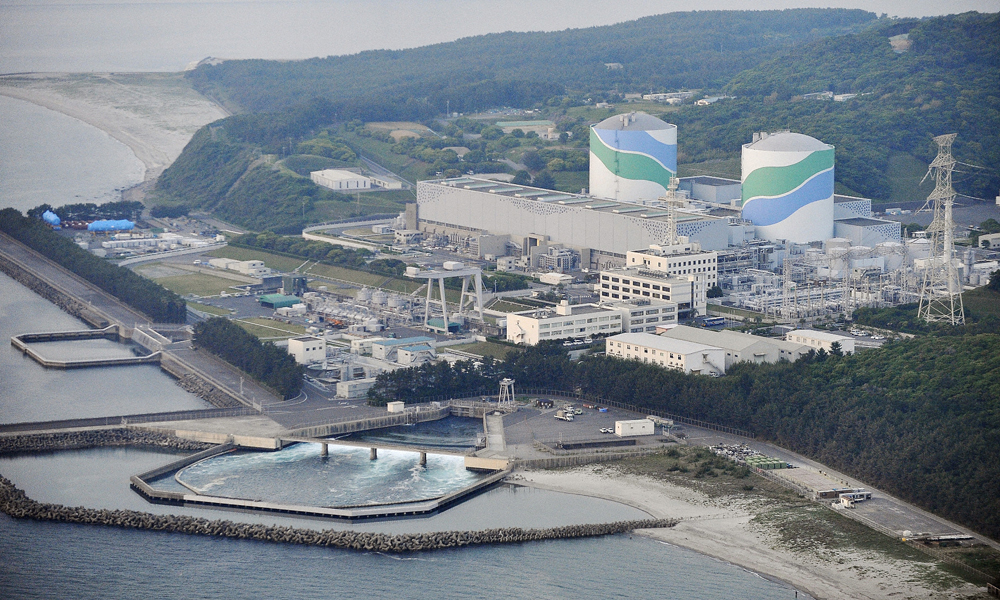

Fire 'em up: The timeline for Japan's first nuclear restarts has slipped from late 2014 to around Q2 this year, likely after the local elections in April. The Nuclear Regulatory Authority has so far approved four nuclear reactors – Kyushu's two Sendai units and Kansai's two Takahama units, but analysts believe as many as nine could return online in 2015. Even if that is overly optimistic, Japan's demand for LNG looks likely to soften.

Tense talks: The industry will be watching to see if the Obama administration can negotiate a deal for Iran to curb its nuclear programme in exchange for lifting sanctions by the deadline on 1 July. An agreement would make way for Iranian LNG exports, but the two sides struggled to bridge wide gaps during talks in 2014.

Taking it offshore: The world's first floating LNG plant is due to start up in H2 2015 off the coast of Colombia. Pacific Rubiales, which is developing the project with shipbuilder Exmar, signed a four-year LNG sales and purchase agreement with Gazprom Marketing & Trading in December to supply around 500,000 tpa of LNG. Petronas also aims to complete its PFLNG 1 plant offshore Malaysia later this year.

Breaking free: Poland's Polskie LNG facility is expected to come online by the end of this summer, providing a new supply stream for a country heavily dependent on Russian gas. The project has been delayed but is more than 95% complete. Qatargas has agreed to amend its LNG sales agreement with PGNiG because of the delay. Lithuania, another Russian gas importer, installed its Independence FSRU in October.

Another shale bonanza: China's shale gas production looks poised to grow this year, on the back of the government's first-ever target for shale output, which is set at 6.5 bcm. Sinopec aims to have built 5 bcm of annual production capacity at its Fuling shale gas field by the end of 2015, and double that volume in 2017. Output from the country's nascent shale sector already jumped in 2014, by 550% to 1.3 bcm. Although that is only 20% of the official target this year, it is still expected to be reached.

CBM-to-LNG: BG Group's QCLNG (pictured) started loading its first cargo on 28 December and will be closely followed by two other CBM-to-LNG plants in Queensland, Origin Energy and ConocoPhillips's APLNG and Santos's GLNG. Both are expected to produce first LNG in H2 2015, while QCLNG's second train is due to start up in Q3. A conventional LNG plant in Western Australia, Chevron's Gorgon LNG, is also aiming to begin liquefaction in late 2015 – but could be delayed.

East and West: The unexpected, landmark deal to export Russian gas to eastern China rocked the LNG industry last year. On the heels of that success, and Europe's concerns about relying too heavily on Russian imports, Moscow and Beijing are now discussing exports from western Siberia, along the Altai route. The project has political as well as commercial appeal, which may drive another agreement this year when the Chinese and Russian presidents meet to commemorate the 70th anniversary of the end of World War II.

Everyone's waiting: The United States is expected to export its first LNG cargo from the lower 48 states in late 2015, when the first four trains at Cheniere Energy's Sabine Pass come onstream. But timing has not been on Cheniere's side. The startup coincides with a seismic change in pricing, as the oil slump drags oil-indexed LNG prices to competitive levels against Henry Hub-linked prices. Cheniere faced similar problems when it developed an export terminal, which it cancelled after US prices started falling as a result of the shale boom.

Climate talks: This year will see the biggest gathering to discuss global emissions policy since the 2009 summit in Copenhagen, this time in Paris in December. The goal will be to reach a binding, global agreement on curbing carbon dioxide – and replacing the Kyoto Protocol. It's a lofty ambition, but last year's China-United States agreement enhances the likelihood of a wider deal. Meanwhile, the EU's emissions trading reforms will continue, with the number of allowances being reduced again to allow for demand to pick up.

Feeding the dragon: China's top two LNG importers, CNOOC and PetroChina, are both racing to complete and bring online two new regasification terminals later this year in Shenzhen, a city in the southern province of Guangdong which is already home to nearly a third of the country's regas capacity. Construction of CNOOC's 4 mtpa terminal in the Diefu district is well underway, whereas PetroChina's project has encountered environmental opposition and is less certain.

Image 1 of 14

Image 2 of 14

Image 3 of 14

Image 4 of 14

Image 5 of 14

Image 6 of 14

Image 7 of 14

Image 8 of 14

Image 9 of 14

Image 10 of 14

Image 11 of 14

Image 12 of 14

Image 13 of 14

Image 14 of 14

- ‹ Previous

- Next ›