2014 in pictures

Posted 15 December 2014Russian Gas Matrix/Interfax

Gazprom/Interfax

PA

Cott Oil & Gas/Interfax

FERC/Interfax

PA

PA

IHS Waterbourne/Interfax

Interfax

Interfax

IEA Africa Energy Outlook

Interfax

Shell

PA

PA

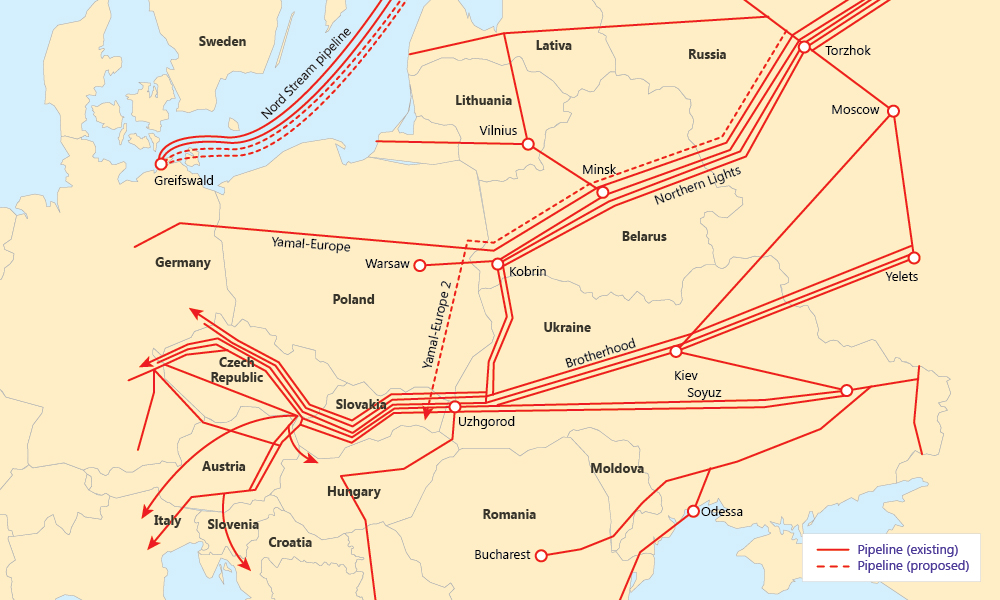

Crisis mode: Russia (allegedly) moved into eastern Ukraine, which led to Crimea's controversial accession, which in turn caused widespread alarm about Europe's energy security as it heads into winter. Russia shut off its gas exports to Ukraine on 16 June and resumed deliveries on 9 December, after Kiev made an advance payment.

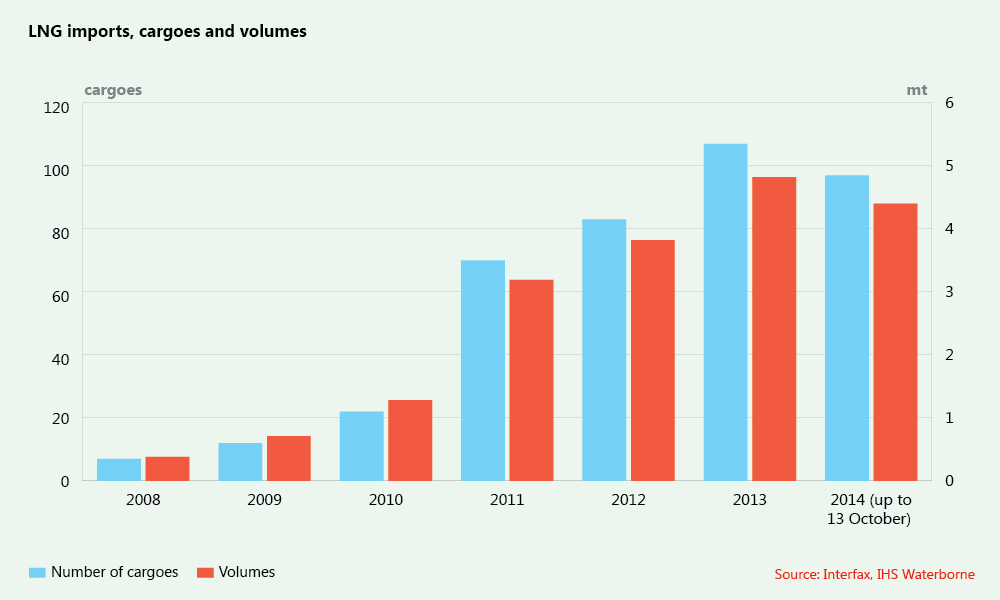

Deal heard round the world: It was a did-they-didn't-they start to the day, but news finally emerged that they had, in fact, done the near impossible. Russia and China shook hands on an eastern pipeline gas supply contract on 21 May, 10 years in the making. The deal sent shivers across the LNG industry, giving rise to questions about whether one of the largest gas demand hubs in the world would still be willing to pay for higher-priced cargoes. The two countries are now discussing a western pipeline deal.

A fickle mistress: The fall in oil prices was the unexpected game-changer this year, turning LNG export projects on their heads and returning the upper hand to Asian buyers weary of expensive oil-linked contracts. Starting in September, oil prices steadily tumbled to five-year lows, leading to expectations that $60-70/bbl for Brent could be a new norm – and bringing these LNG contracts in line with new Henry Hub-linked prices. LNG exporters cautioned, however, that it could once again rebound without warning.

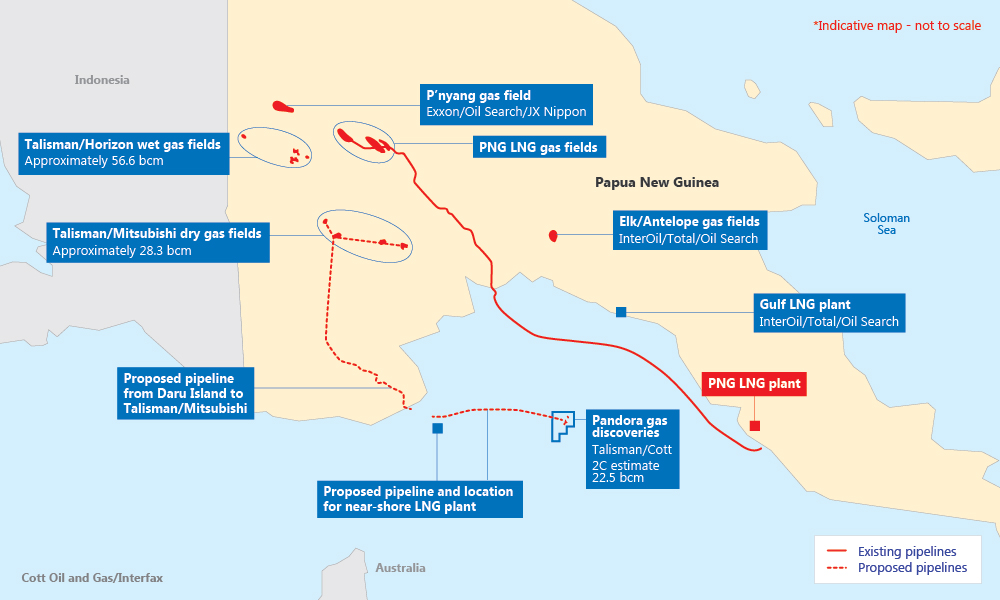

Making it look easy: ExxonMobil brought its 6.9 mtpa PNG LNG plant in Papua New Guinea online six months ahead of schedule and under the cost of equivalent projects in Australia – putting delays and overruns in the larger country to shame. However, the unexpected addition of new spot cargoes at the start of the summer helped to drag Asian LNG prices to as low as $10/MMBtu.

Here they come: The number of LNG plants under construction in the United States rose from one to four after the Cameron, Dominion Cove Point and Freeport projects cleared the final Federal Energy Regulatory Commission hurdle. More could reach FID in 2015, although the decision to move the Department of Energy's approval for exports to non-free trade agreement countries to the end of the process, rather than the beginning, will weed out the weaker projects.

Adieu: The industry lost a charismatic, humorous heavyweight when Christophe de Margerie's airplane crashed during takeoff in Moscow in October. 'Big Moustache', as the Total CEO was nicknamed, spoke out against sanctions on Russia and Iran, saying they would ultimately harm the West by sending oil prices soaring, and criticised other IOCs for drilling in the Arctic, saying it was too dangerous. He had been in Moscow to meet Prime Minister Dmitry Medvedev.

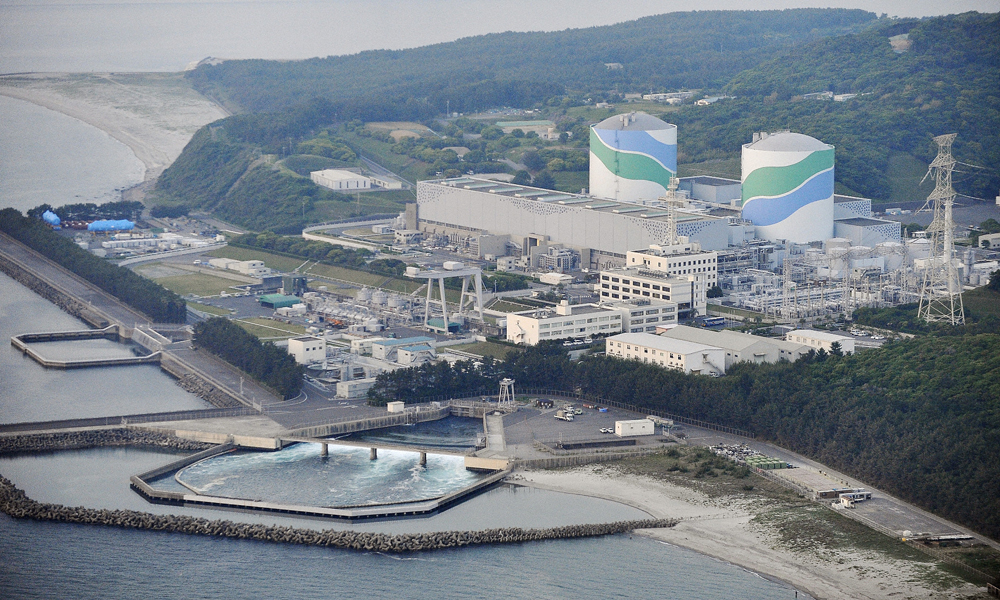

First spark: Japan's Nuclear Regulatory Authority gave Kansai Electric the OK to restart two of its Sendai nuclear reactors, giving a glimmer of hope that more could follow. The units are expected back online by early 2015, more than one year after the country switched off its last reactor. However, Japan's worse-than-expected economic slowdown, and a surge in solar energy, will likely dent its demand for gas in 2015.

Watch out for bottlenecking: LNG cargoes began queuing off the coast of Argentina in late September, as the country struggled to pay its import bills because of depleting dollar reserves and the unusually warm winter pulled demand down. The fiasco left Argentina's main LNG suppliers, Gas Natural and BP, short of tankers for their Trinidad and Tobago cargoes.

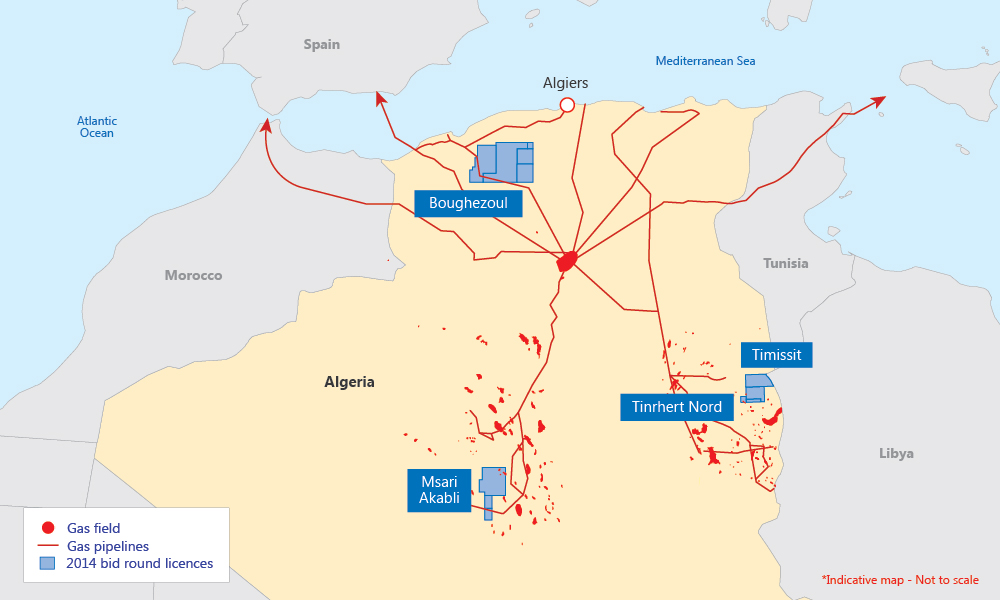

Pointing fingers: Algeria's latest licensing round drew little attention, with just five bids submitted for the 31 available blocks. This was better than the results of the previous tender in 2011, when the government awarded one block, but it wasn't good enough and led the government to begin an inquest into what went wrong. Meanwhile, as the country's conventional oil and gas resources decline, Algiers has set an ambitious goal of beginning shale gas production as soon as 2022.

In the bin: Russian President Vladimir Putin cancelled the South Stream pipeline project with little explanation in late November, and outlined an alternative plan to build a gas hub on the border between Turkey and Greece. Experts say the plan, to essentially re-route the pipeline, would bypass European competition law. But even without South Stream, Gazprom remains Europe's best source for affordable, abundant gas – further pressuring the bloc to diversify.

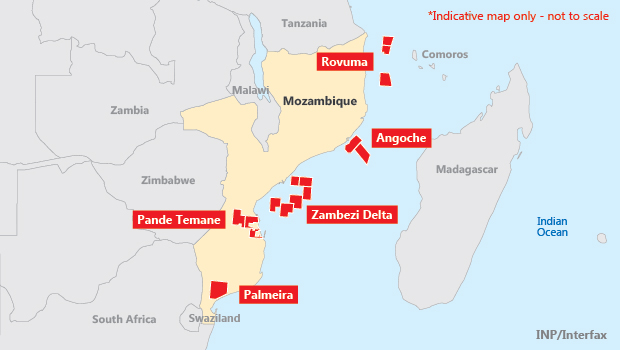

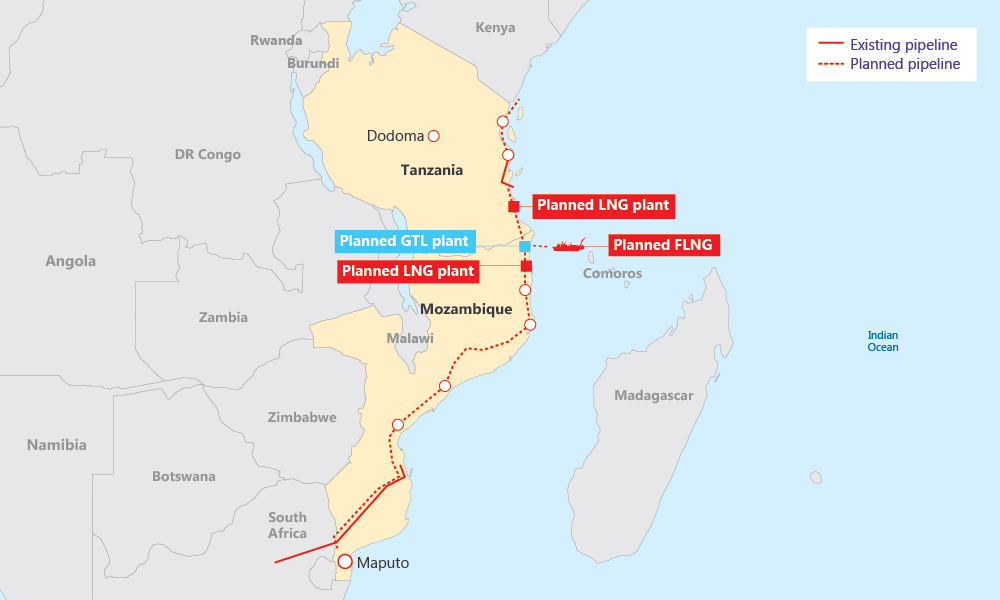

Letter of the law: Mozambique's new decree law covering the Rovuma Basin LNG developments was passed by the Council of Ministers in early December. It came just over a month after Maputo launched its fifth licensing round, despite some objections to measures in the petroleum law the country introduced in August. However, scepticism about the likelihood of East African LNG (from Mozambique or Tanzania) coming online before 2020 is spreading, particularly in light of the oil price slump.

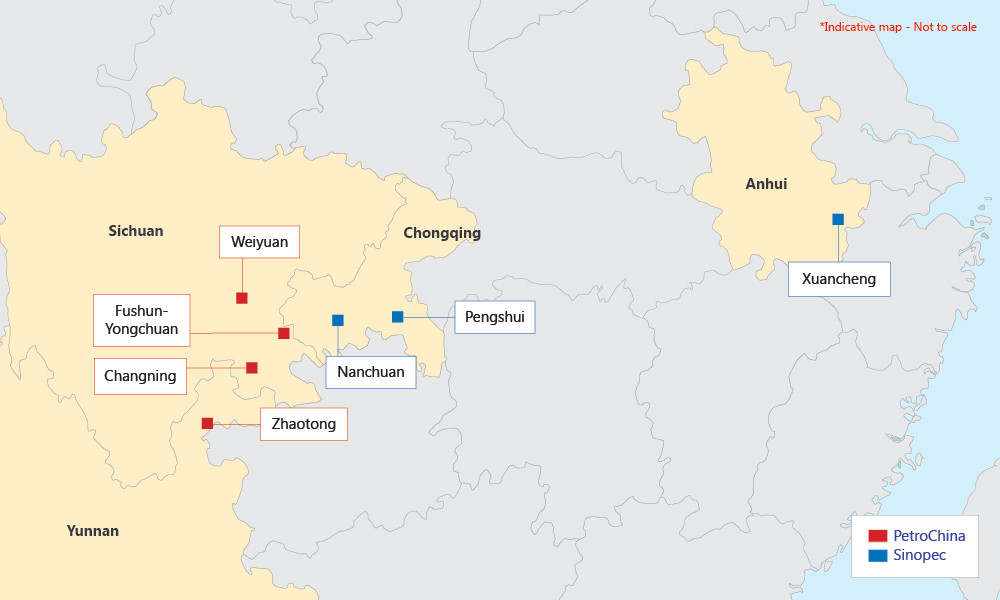

Graft probe: CNPC's shale gas operations in Sichuan province have been forced to a halt as a number of company executives have been caught up in one of the biggest anti-corruption investigations in the Chinese state sector in recent years. Shell, CNPC's partner in the block, has moved some of its foreign workers back home and is considering scaling back its investment. Meanwhile, the timeline for China's third shale block auction continues to slip into later 2015.

Fill 'er up: New Year's Day will bring with it a stricter set of regulations for shipping in the EU, requiring owners to cut the amount of sulphur in maritime fuel from 1.5% to 0.1%. LNG will be the likely winner, but is more expensive. Ships that don't comply will therefore gain a significant advantage over those that do, and the limited number of LNG refuelling stations will make it a difficult switch. Shell is already looking to step in, with plans to build a specialised LNG refuelling vessel (pictured here).

New chapter: Mexico announced in mid-August that it would offer 169 blocks in its inaugural bid round in mid-2015, as the historic opening of the country's oil and gas sector continued. More than half of the blocks are classified as having mainly dry and wet gas potential, and more than 30 drilling prospects have already been identified. Mexico's best gas prospects are within its 'oil patch' – which includes deepwater and crossborder fields in the Gulf of Mexico, as well as the central Chicontepec region – and unconventional blocks in the northeast Sabinas-Burro Picachos and Tampico-Misantla regions.

Serious commitments: Some of the world's largest emitters took initial – though still significant – steps towards curbing their pollution this year. EU leaders decided to cut CO2 emissions by 40% by 2030, although they failed to agree on renewable energy and energy efficiency targets. A few weeks later, US President Barack Obama and his Chinese counterpart Xi Jinping shook on a historic deal.

Image 1 of 15

Image 2 of 15

Image 3 of 15

Image 4 of 15

Image 5 of 15

Image 6 of 15

Image 7 of 15

Image 8 of 15

Image 9 of 15

Image 10 of 15

Image 11 of 15

Image 12 of 15

Image 13 of 15

Image 14 of 15

Image 15 of 15

- ‹ Previous

- Next ›