Mozambique government approves Eni’s Coral FLNG

Mozambique’s government has approved the plan of development for Eni’s Coral FLNG project, paving the way for an FID later this year, sources in Maputo have confirmed.

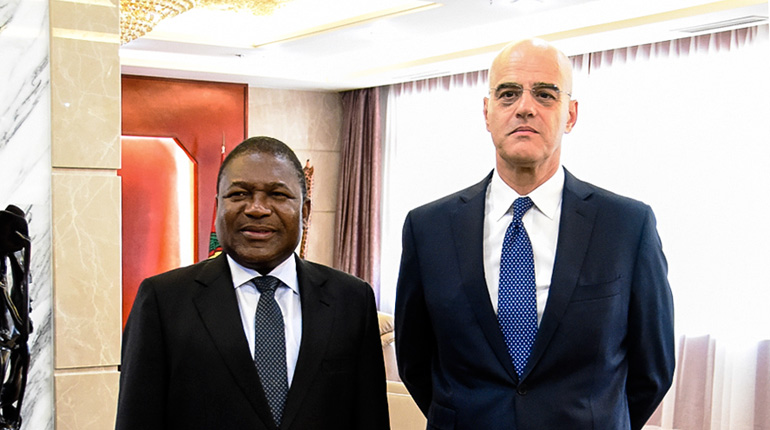

Eni Chief Executive Claudio Descalzi and Mozambique President Filipe Nyusi in May 2015. (Eni)

Eni Chief Executive Claudio Descalzi and Mozambique President Filipe Nyusi in May 2015. (Eni)

Mozambique’s government has approved the plan of development (POD) for Eni’s Coral FLNG project, paving the way for an FID later this year, three well-placed sources in the capital Maputo have confirmed.

The partners in Offshore Area 4 are waiting for written confirmation on exactly what the Council of Ministers has sanctioned, Natural Gas Daily understands.

The approval is the result of more than a year of tough negotiations with state petroleum regulator INP. Eni initially submitted the POD for the 3.4 mtpa floating facility in December 2014, but there were several key challenges that the already over stretched regulator needed to negotiate – chief among them the lack of domestic market offtake (DMO) from the offshore facility.

The sources told NGD that an Eni delegation led by Chief Executive Claudio Descalzi flew to Maputo last week to speak with President Filipe Nyusi and wrap up negotiations. As part of a sweetener to the final deal, Eni and its partners offered an improved local content and training plan.

Initially INP sought a DMO of up to 25% from the Coral field, but as building a pipeline to shore would have been too expensive – it was one of the reasons Eni opted for a floating project in the first place – this option was not pursued.

Gas condensates

Instead, Eni and its Area 4 partners will offer gas condensates – a by-product of the liquefaction process – to the government at a low cost, NGD understands. While Rovuma Basin gas is mostly dry, Coral gas is slightly wetter than other fields in the basin. As part of the deal, Eni had to put forward plans for how the condensates – which are valued at roughly 97% of the price of Brent crude – can be used to encourage downstream industrialisation in Mozambique, according to one of the sources.

It is possible Mozambique could negotiate to buy LNG from Coral via offtaker BP when the project comes online in 2020 and regasify it at economic hubs further south, such as Maputo. Several industry sources have said this option could be preferable to building a 2,600 km pipeline from Palma, on the northern tip of the country, to the capital in the south. However, while the government likes the concept of small-scale LNG, the volumes may be too small to make it economic in Mozambique.

The approval of the POD means Eni is in a position to move forward with the financing of the $8-9 billion project.

NGD understands that, although the Italian oil major is pushing to make the FID as soon as possible, other partners in the Area 4 consortium – which is comprised of China National Petroleum Corp. (20%), Kogas (10%), Galp Energia (10%) and state oil company ENH (10%) – may struggle to fund their equity stake in the project and are keen to delay the decision until at least the end of the year.

Financing

Coral is an expensive project. Its breakeven price stands at around $80-90 per barrel according to some estimates, but costs could come down if certain elements are factored into the final price – which could include inflation, a potential increase in capacity at the project to 3 mtpa, and the facility’s financing via a special purpose vehicle.

Eni itself, which holds a 50% stake in Area 4, is looking to sell down around a 25% interest in the licence.

While the bulk of the financing for Coral FLNG will come from export credit agencies in South Korea, China and Italy, the Italian major presented an overview of the project to commercial banks in London in October. NGD understands that while banks are interested in lending, they are far from starting serious negitations. Coral remains a technically risky project – FLNG is a new technology and its application at the Coral field is further complicated by the high swells in the Mozambique Channel. It could take a lot of assurance to make the banks comfortable with lending.

NGD understands the partners are likely to go back to the banks to start discussions in H2 2016, although some lenders have suggested 2017 is more likley.

The Area 4 consortium has yet to select an EPC contractor for Coral FLNG, although Technip, along with partners Samsung Heavy Industries and JGC, is still the lead bidder on the project. NGD understands the partners may wait and ride out the low oil price wave a little longer to squeeze the bidders and further reduce costs – or to shift more of the project’s technical risk on to contractors.

This story was updated on Wednesday at 4.40pm. The original story said the capacity of the Coral FLNG plant would be 2.5-3 mtpa, but Eni later confirmed that it will be 3.4 mtpa.