Indonesia facing up to future of LNG imports

Gas pipelines, Indonesia. (PA)

Gas pipelines, Indonesia. (PA)

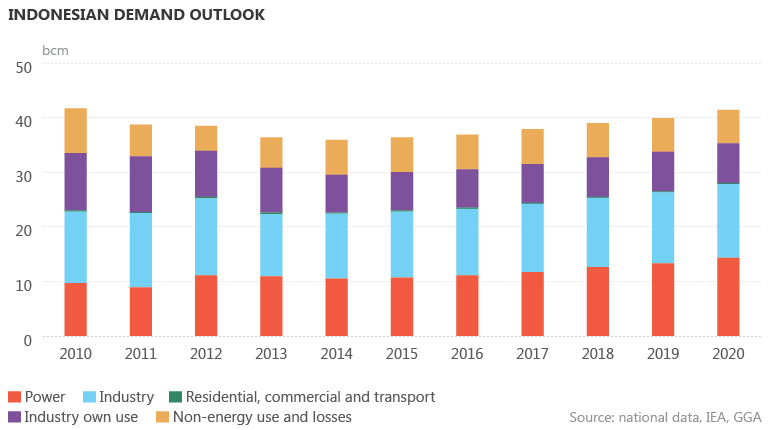

Indonesia’s gas sector is going through a period of substantial change. In the next 10 years, the country could move from being one of the world’s leading LNG exporters to being a net importer of gas. As Indonesia’s demand grows, domestic production is unlikely to meet both the home market’s needs and the country’s export commitments. Even as export volumes drop and more Indonesian output becomes available for the domestic market, the country’s dependence on imports is likely to grow.

Indonesia’s gas market growth has been constrained by a lack of supply. The government introduced a domestic supply obligation in 2002, which requires that a minimum of 25% of supply from production-sharing contracts is allocated to the Indonesian market. A priority allocation mechanism was introduced in 2010 that prioritises gas for use first by the oil and gas industry and then by fertiliser producers, the power sector and, finally, other industries. However, even with these measures in place, the market has suffered supply shortages. The average growth in demand was around 4% per year between 2000 and 2010, but demand fell on an annual basis between 2011 and 2014. Consumption grew last year to around 36 bcm and has increased further in 2016, with demand expected to be around 37 bcm for the year as a whole. However, this will still be lower than 2012 consumption levels.