Movers and shakers

Posted 26 November 2014Interfax

PA

Interfax

Eni

BG Group

PA

BG Group

FT

Peter Voser: Voser stepped down from Shell at the end of 2013, after four years as chief executive. One of his biggest regrets was leading the group into the United States shale bonanza – with a $24 billion investment that proved slow to pay off, he told the Financial Times before leaving. He then joined a rising star in the LNG world – Singaporean sovereign wealth fund Temasek, which owns Pavilion Energy – in June, as a board member. Here he is at the World Gas Conference in Kuala Lumpur in June 2012.

Ben van Beurden: Shell's downstream director took over from Voser on New Year's day, after 31 years at the company. In that time he has worked in the LNG, manufacturing and chemicals divisions, among others. His appointment was widely seen as a change in tack, with an emphasis on value rather than high volume, capital-intensive projects. Here he is (on the right) taking a long-armed selfie with students at a Shell event in May in the Netherlands.

Paolo Scaroni: Paolo Scaroni said goodbye to Eni in April, after eight years as chief executive – during which time the six-legged dog (cane a sei zampe, as the major is known at home) extended its reach beyond Italy and into Africa and Asia, but also faced legal battles. Here he is with Mozambican Prime Minister Alberto Vaquina in 2013. But it was only a short break for the ginger-haired executive; he was named deputy chairman of Rothschild, a financial advisory firm, in June.

Claudio Descalzi: Scaroni was quickly replaced by Descalzi, pictured here with the CEO of Mexico's Pemex, Emilio Lozoya Austin, in October. Descalzi joined Eni in 1981 as 26-year-old field petroleum engineer and project manager for developments in the North Sea, Libya, Nigeria and the Congo, and most recently worked as chief operating officer of the exploration and production division. Upon first impression, City analysts were underwhelmed by Descalzi, despite his emphasis on strict capital discipline.

Chris Finlayson: Sir Frank Chapman's retirement from chief executive in 2012 set off a series of shuffles among executives at BG Group. Finlayson replaced Chapman at the start of 2013, after a three-year stint as managing director of BG Advance and 30 years at Shell. Here, he's pictured discussing European supply security in 2012. But his stay in the CEO office was short-lived; he unexpectedly resigned in April with immediate effect, "for personal reasons". He found another home four months later, as chairman of Papua New Guinea-focused InterOil.

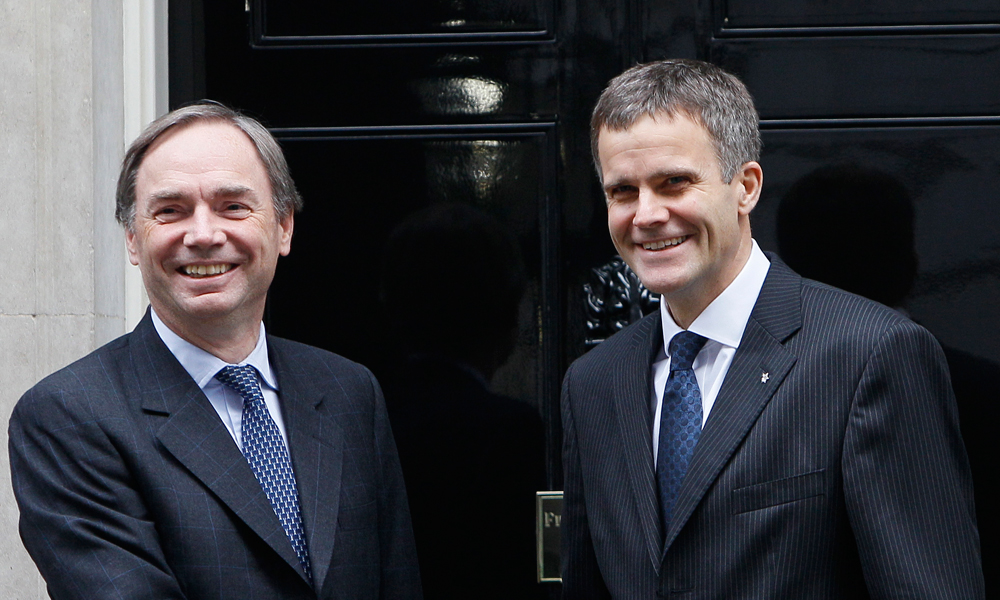

Helge Lund: Six months after Finlayson's departure, BG announced its new choice for chief executive – Lund, whom the group poached from Norway's Statoil. Andrew Gould, BG's non-executive chairman, has been overseeing the post since April and will hand the reins over on 2 March 2015. The appointment appears to be a promising one, considering Lund's show of calm and leadership during the hostage crisis at In Amenas and the global credit crunch. Here he is (on the right) with Centrica CEO Sam Laidlaw outside 10 Downing Street in 2011.

Betsey Spomer: The shake-up at BG also includes Spomer, the company's senior vice president of global business development until October, when she became president and CEO of Jordan Cove LNG and executive vice president of its parent, Veresen. Jordan Cove is developing a greenfield LNG plant in Oregon, which is expected to reach FID around H2 2015. Her departure follows that of Martin Houston, BG's COO until November 2013, and Simon Lowth, the chief financial officer until July 2013. Here Spomer is speaking at LNG 17 in 2013.

Christof Rühl: Rühl, the man behind BP's annual energy statistical reviews and outlooks, stepped down from his position as chief economist in May to become the Abu Dhabi Investment Authority's first global head of research. Rühl's predictions over his five years in the position included the statement in 2012 that North America would make the continent self-sufficient for gas within two decades, and that shale would have little impact in Europe. Here he sits on the panel (on the right) for FT's Global Shale Energy Summit in October 2013. BP replaced him with the Bank of England's Spencer Dale, who started in October.

Image 1 of 8

Image 2 of 8

Image 3 of 8

Image 4 of 8

Image 5 of 8

Image 6 of 8

Image 7 of 8

Image 8 of 8

- ‹ Previous

- Next ›