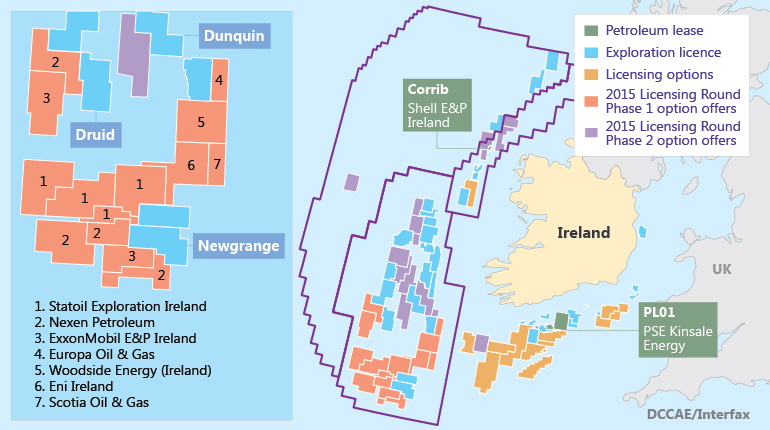

The area for the Irish Atlantic Margin Licensing Round.

The area for the Irish Atlantic Margin Licensing Round.

The Newgrange prospect off the west coast of Ireland could, if proven, turn out to be the most significant gas find in European waters since the 1960s.

London-listed Providence Resources announced on 12 July that it had potentially unearthed 385 billion cubic metres of gas at its prospect (FEL 6/14), having acquired 2D seismic data on the area.

Providence appears confident the prospect is gas rather than oil, only referring to it as such in its AGM.

"We think it’s gas but have modelled oil as a sensitivity," John O’Sullivan, technical director for Providence Resources, told Interfax Natural Gas Daily. The trap covers the equivalent of roughly four North Sea blocks, he added.

Andrew Vinall, technical director at Hannon Westwood, said the Providence announcement represented "the largest resource figure for a single exploration prospect in Northwest Europe for as long as I can remember – if proven it would be potentially larger than Johan Sverdrup in Norway and twice that of the largest UK gas field [Leman]".

However, a lot of work has to be done to determine how much can be viably recovered. "These are estimates and the target still has to be drilled," Job Langbroek, senior resource analyst at Davy Research, told Interfax Natural Gas Daily. "But this amount of gas is certainly very substantial and would be a world-class discovery if anything close to that amount can be recovered."

The bullish headline figure refers to in-place gas – Vinall suggested a better field development estimate is one he said was suggested by Providence – 65% of that amount, or 249 bcm.

"I would think due to the depth [the actual figure] might be [even] less. However, that depends on the quality of the reservoir," added Vinall, who said the large amount of geological uncertainties make this "a true wildcat prospect". Risk factors include the presence and quality of source rock, as well as top seal and reservoir quality.

The 385 bcm resource potential was estimated by the Schlumberger Exploration Collaboration Project, which has in large part been established to help Providence farm out some of its assets.

"This is a very early stage play and [Providence] were just trying to highlight the prospectivity of the area," said Langbroek.

The company has been actively looking for partners to capitalise on its exploration acreage – including at Newgrange and its other gas prospect Spanish Point (condensate).

Providence is a small E&P player that has had its share of financial difficulties, but it has recently been in a position to raise enough equity to pay off debt and a legal settlement.

Ronan MacNioclais, partner at PwC Ireland, told Interfax Natural Gas Daily that while Providence put a "huge amount of work" into raising the cash, he said it was "excellent" to see a company exclusively focused on Irish E&P raising that level of equity in the markets at a time when oil prices are low and volatile. "It is a positive sign for activity in the Irish E&P sector in the next couple of years, but we need to see some drilling activity to galvanise interest in the Irish E&P sector," he added.

Langbroek also believes this ability to raise cash is a positive sign for Irish exploration. "It ties in with the level of interest shown in the licence rounds," he noted.

The area immediately next to Newgrange attracted significant interest from heavy hitters in the latest North Atlantic Margin Licensing Round – two blocks adjacent to it were awarded to China National Offshore Oil Corp. through its subsidiary Nexen Petroleum, and another two went to ExxonMobil E&P Ireland and Statoil.

Well drilling

While there has been no well drilling announcement for Newgrange, Providence has confirmed it would be drilling a well at the Druid oil prospect in 2017. The company estimates that if it was to include Newgrange in this campaign, taking into account economies of scale the well should cost around $22.5 million.

An exploration well at Dunquin, which is similar in rock type and age to Newgrange, cost close to €200 million ($224 million) in 2013, according to press reports.

"With the potential sums involved in drilling such prospects in the harsh weather and ocean conditions of the Goban Spur Basin [where Newgrange is located], and potentially developing a resultant discovery, any company visiting the dataroom will want to do a substantial amount of their own work to satisfy themselves the risks are quantifiable and acceptable, and that any discovery would be commercial," Vinall warned.

Langbroek said it is anyone’s guess whether Providence will find a partner to drill an exploration well at Newgrange, but in light of its financial pressures having been resolved, the company "should be in a stronger negotiating position".

O’Sullivan told Interfax Natural Gas Daily on 2 August a well-drilling programme for Newgrange "could possibly be hooked on the back of the 2017 Druid well programme but needs a farminee to fund – even though it is very cheap".

He said the majors surrounding Newgrange were "carpeting the area with 3D" this summer and next. The possibility of surveying Newgrange in the process is on the cards and a well-drilling programme could ensue as a result, he added.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].