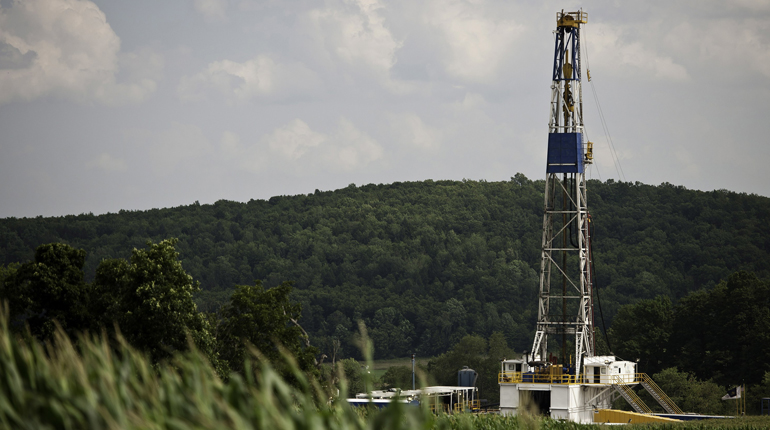

Two planned LNG projects in Nova Scotia hope to source gas from the Marcellus shale play. (Statoil)

Two planned LNG projects in Nova Scotia hope to source gas from the Marcellus shale play. (Statoil)

New climate change targets unveiled by Canadian Prime Minister Justin Trudeau last week may affect the future of every planned LNG project in Canada. However, the two plants intended for the coast of Nova Scotia – the 8 mtpa Bear Head and the 10 mtpa Goldboro LNG – face an added issue: securing gas supply.

Both export projects plan to source their gas from Canadian reserves and the huge Marcellus shale play in the United States. But their success will depend on how and when they are able to obtain these supplies.

Bear Head project developer LNG Ltd is hoping to take an FID next year, but this will depend on whether it can source gas in time. Darshi Jain, Bear Head’s project director, told Interfax Natural Gas Daily his company was looking at "several options" for gas supply, "including stranded resources in western Canadian reserves".

Jain said Bear Head may still source gas from the US, but with Canada’s west coast LNG projects not moving forward as expected, LNG Ltd is talking to selected western Canadian investors to look at the potential of delivering gas to Bear Head under a tolling arrangement.

Sourcing gas from western Canada to Nova Scotia would be difficult as current pipeline infrastructure is inadequate, but Jain pointed to two options for delivering gas from the west to the east coast. The first would involve a gas pipeline running parallel to the proposed Energy East oil pipeline, which aims to deliver oil from Alberta to the east coast. The second option would use the Portland Natural Gas Transmission System and deliver gas to eastern Canada via a New England pipeline network.

However, industry insiders are sceptical the west-to-east-coast plan is workable.

"It doesn’t sound practical," said Dirk Lever, head of research for energy infrastructure at Calgary-based AltaCorp. Capital. Tolling fees and new transport costs would make it difficult to make a profit, he added.

Sourcing gas from eastern Canadian reserves off the Nova Scotian coast and onshore shale reserves in New Brunswick would also be difficult. There has been limited drilling off Nova Scotia and no shale gas production in New Brunswick since fracking was banned in 2014.

Mark Brown, Goldboro LNG’s director of project development, said the company plans to make an FID by the end of the year and is optimistic about sourcing gas.

Goldboro is located at the start of the 1,100 km Maritimes and Northeast pipeline (M&NP), which delivers Canadian gas to the northeastern US. Because of this, "Goldboro has direct access to gas supply offshore and also plans to potentially source gas from western reserves, the Dawn Hub, and the US Marcellus shale play", Brown said. "The M&NP pipeline is on the project site and it provides the necessary interconnections with the pipelines needed to bring gas from those regions," he explained.

US issues

Although Goldboro and Bear Head have permission to source gas from the Marcellus – which is big enough to supply both plants – the M&NP needs major improvements.

The pipeline is already constrained, particularly during the winter in New England, when there is high demand. Therefore, diverting gas to feed any proposed east coast Canadian LNG export plant would likely result in strong opposition from a region that already pays high prices for gas because of its inadequate pipeline capacity.

One of the two large pipeline projects planned to deliver Marcellus gas via New England to Canada has been cancelled. US-based Kinder Morgan withdrew its federal application in April for its 680 km, $3.3 billion Northeast Energy Direct Pipeline after failing to secure buyers and as a result of pressure from environmental and political protests.

A competing project, the Access Northeast pipeline proposed by Spectra Energy Partners, won the financial support of New England-based utilities but has also run into trouble. It faces opposition from several energy companies over pipeline capacity disagreements as well as protests by local communities and environmentalists.

The success of the two Nova Scotia projects may also come down to price. "Europe is a potential market for the LNG, but it will have to be supplied at market prices," a US LNG analyst, who wished to remain anonymous, told Interfax Natural Gas Daily. "With European gas demand weak, and the US and Qatar already targeting Europe, will these prices support an investment in a greenfield LNG plant – even when transportation costs are lower than from the Gulf of Mexico?"

Bear Head and Goldboro have both received export licences from the Canadian energy regulator, the National Energy Board. The Canadian government has approved licences for the two projects to import gas from the US, and both projects have approvals from the US Department of Energy to import US gas and re-export it as LNG.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].