Three ports, three solutions for South Africa’s power crisis

South Africa will launch its integrated LNG-to-power tender in Q2 2016 and will seek to import LNG into all three selected ports, the head of the IPP programme tells a conference in Cape Town.

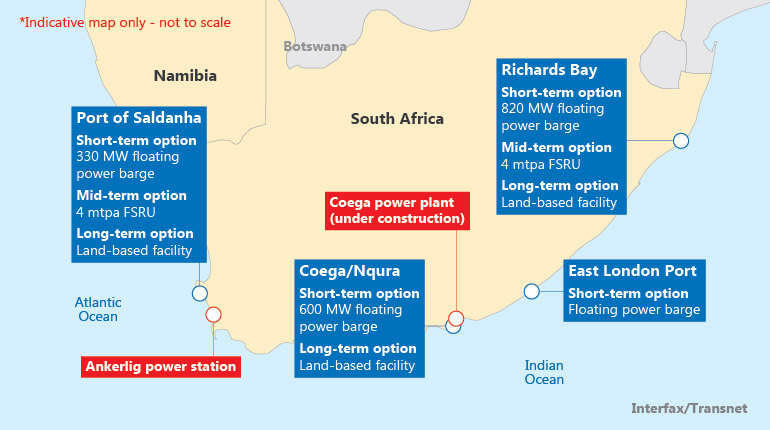

South African power infrastructure plans.

South African power infrastructure plans.

South Africa is likely to opt for an integrated LNG-to-power solution for its 3.1 GW gas-fired independent power producer (IPP) tender to streamline development of the country’s nascent gas industry.

"If it’s not a bundled approach, there will be very clear reason why it’s not," Karen Breytenbach, head of the IPP department, told delegates at the South Africa Gas Options conference in Cape Town on Wednesday.

The Department of Energy’s request for information (RFI) regarding the tender had yielded 170 submissions by the time it closed on 20 July, approximately half of which showed a willingness to work on the project on an integrated basis. Around 100 of the submissions focused on importing gas.

The request for qualifications for the mid- and long-term gas-fired programme will be released before the end of the year. The request for proposals (RFP) will be published in Q2 2016.

The IPP department will launch the RFP for short-term power solutions – which will include floating barges as well as alternative supply options, such as underground coal gasification and CBM – before the end of 2015.

There will be LNG import options at all three of the ports selected by logistics and pipeline operator Transnet – Richards Bay, Saldanha Bay and Coega – and both floating and onshore terminals will be considered.

The volume of LNG that will be imported, and whether it will be via a land-based terminal or FSRU, will be decided based on the suitability of the port, the projections for gas use in industries beyond the power sector, and on whether the country’s shale gas exploration programme – which has not yet started – is a success.

FSRUs a certainty

Most industry watchers expect commercial production of shale from the Karoo Basin to be at least a decade off – if it happens at all – so an FSRU will be needed in at least one port to meet mid-term gas demand. The FSRUs could then be replaced with larger, onshore terminals if domestic gas production proves minimal.

"It may not be the same solution for every port. We will go port by port and analyse what can happen and what can’t," Breytenbach told Interfax.

The IPP department will likely launch the tenders for each port at six-month intervals. This phased approach will allow the team to adjust and improve each tender according to the market response, she said.

Of the three ports, Coega is the only one that has been deemed unsuitable for an FSRU because the turning circle is too tight, but it could support an onshore terminal. Richards Bay is the only port that already has a gas demand base, albeit a low one. At the other two ports a gas industry and demand will need to be built from scratch.

"There will definitely be an early power programme and the team will be ready to release the documents before the end of the year," said Breytenbach.

Short-term option

The only option for meeting South Africa’s short-term demand is to use floating power barges, which will run on either heavy fuel oil or diesel.

Transnet has looked at options to install ships at all three ports and is providing facilities to enable their delivery. However, bidders are not limited to these ports, and East London has been flagged as another possible location for a barge.

Although power barges provide the quickest energy solution, they are also expensive, and the heavy fuel oil they burn is a problem from an environmental perspective, a source at Transnet told Interfax. "LPG could be used as an alternative, although at the moment there aren’t any LPG storage tanks at the ports," the source said.

As well as LNG-to-power projects, the government is still considering importing either gas or power from South Africa’s neighbours. Proposals were submitted in the RFI from Botswana, Mozambique and Namibia.

"We’re not ruling those out. We are still looking to see how we can make sure [there is an] integrated regional approach, and not only look at what we, South Africa, need," said Breytenbach.

The industry welcomed the confirmation from Energy Minister Tina Joemat-Pettersson on Tuesday that gas would be the "cornerstone" of baseload electricity supply in South Africa, rather than just mid-merit use as previously indicated.

Investors at the conference also stressed the importance of increasing the programme beyond the initial planned capacity addition of 3.1 GW to justify the huge costs in building the gas infrastructure from scratch.

"More megawatts will increase demand and keep prices down," Jonathan Hoffman, senior business development director at Globeleq, told investors.

Liked this article?

Sign up for exclusive, accurate and up-to-date natural gas news, analysis and intelligence, with global coverage of every phase of the gas chain.

By logging in or signing up for a free trial, you are agreeing to our terms and conditions, privacy policy and cookie policy.