European supply-side price support will be short-lived

15 March 2017

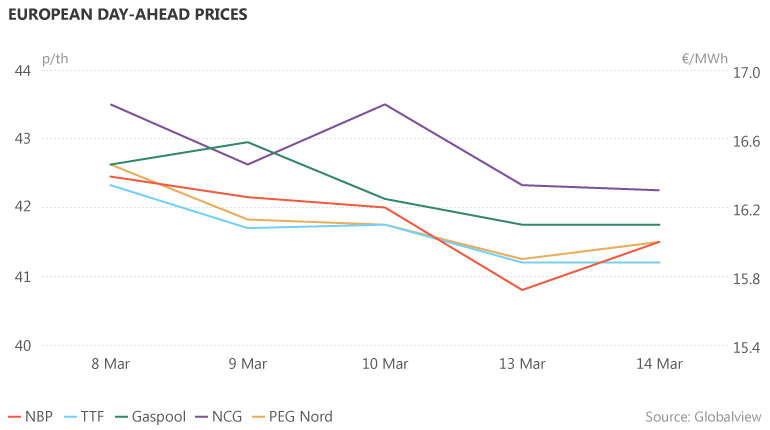

The NBP day-ahead price increased slightly at the start of the week, rising by 2% on Tuesday to reach 41.5 p/th. Although demand was weak, a drop in flows supported the price rise. Lower levels of piped supply from Norway and a temporary outage at the South Hook LNG terminal reduced the volumes entering the UK market. However, this trend is not expected to last. UK gas demand is forecast to be 10% below seasonal norms on Wednesday, according to the forecast from National Grid, and supplies into the UK market are expected to be high, which will put pressure on prices.

The UK’s Rough gas storage facility was supplying volumes to the market on Wednesday. However, the facility is set to remain closed for injections until the start of July, which would give the UK less time to rebuild stocks before winter. The availability of Rough next winter is also uncertain. UK regulator Ofgem recently approved a request by Centrica Storage, the facility’s operator, to set Rough’s minimum capacity to zero for the 2017/2018 gas storage year. As stocks at the facility are low and the period for reinjections will be short, the volume of gas available from Rough next winter is highly likely to be lower than in previous years. This means the UK will increasingly depend on imports, including LNG, to meet the needs of its market.

Log in or register for a free trial to continue reading this article

Already a subscriber?

If you already have a subscription, sign in to continue reading this article.

Sign inNot a subscriber?

To access our premium content, you or your organisation must have a paid subscription. Sign up for free trial access to demo this service. Alternatively, please call +44 (0)20 3004 6203 and one of our representatives would be happy to walk you through the service.

Sign up