Cyprus’s offshore blocks and third licensing round.

Cyprus’s offshore blocks and third licensing round.

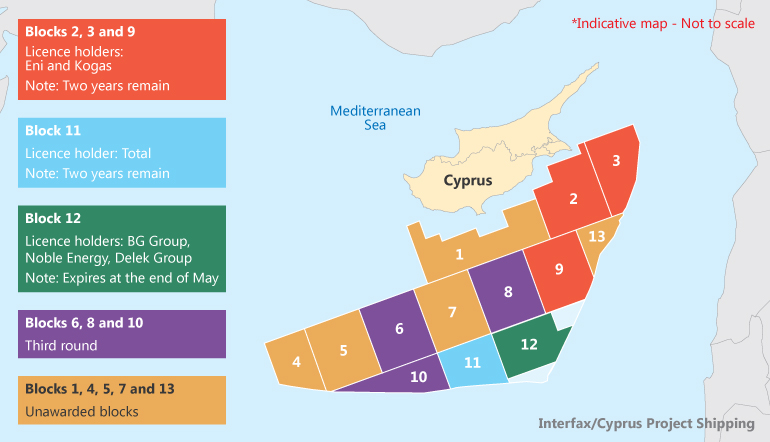

Cyprus has invited bids for three offshore exploration licences in what will be the country’s third licensing round. The blocks are likely to attract bids from Eni and Total, which already hold acreage and which sources say are looking to expand their exploration footprints.

The Ministry of Energy, Commerce, Industry and Tourism opened applications for licences to explore blocks 6, 8 and 10 on 24 March. In the previous round it offered contracts for all of Cyprus’s offshore blocks, with the exception of Block 12.

Sources in the Cypriot oil and gas industry have said executives from Eni and Total lobbied the government to tender contracts for the three areas. The ministry did not respond to questions on the selection process for the three blocks before publication.

IOCs have until 22 July to submit their offers, but this tight deadline should not be a problem for Total and Eni. "The two companies know exactly what they’re looking for so it shouldn’t take them long to respond," Charles Ellinas, an independent energy consultant, told Natural Gas Daily.

Total already holds a licence to explore Block 11 and is expected to bid for Block 10, which it explored and subsequently relinquished. "At that time they were looking at possible targets that were similar to Aphrodite, Tamar and Leviathan, which are sandstone formations," said Ellinas. "They were not looking for carbonate formations. They didn’t find any [sandstone reservoirs] so they did not continue."

Expectations for Cyprus’s southern offshore acreage have since been raised by the nearby discovery of the Zohr field, a carbonate formation in Egypt’s territorial waters discovered last year. "After Zohr they realised that the carbonate formations might have prospects," said Ellinas.

Constantinos Taliotis, partner in charge of PwC’s energy team in Cyprus, agrees. "The discovery of Zohr [field in Egypt] was good news for the East Med and has attracted the attention of the industry as it enhances the potential of the region as a hydrocarbons producing area," he said. "I assume that interested parties are reassessing data that could potentially lead to additional discoveries."

Data reassessment

Zohr encouraged Total to reassess the data it previously collected on blocks 10 and 11 to look for potential carbonate reservoirs. Total may also submit a bid for Block 6, which lies directly to the north of Block 10. Total has revived its exploration plans for Block 11, having recently secured a two-year extension of its licence. It plans to drill more exploration wells by the end of this year.

Meanwhile Eni is thought to be eyeing Block 8, which is adjacent to its existing blocks in the northeastern section of Cyprus’s offshore area. It also recently secured a two-year extension of its three exploration licences. Block 8 is considered promising because of its location in relation to the Eratosthenes subsea mountain.

"The Eratosthenes subsea mountain seems to have formed with carbonate structures that are similar to Zohr," Yiorgos Lakkotrypis, Cyprus’s energy minister, told NGD earlier this month. The formation has raised Eni’s hopes for the blocks for which it already holds licences.

"[Eni is] recalibrating their data and we should be hearing about their plans [for blocks 2, 3 and 9] very soon too," Lakkotrypis added.

While Total and Eni are likely to want to expand their acreage, they could face competition from other IOCs looking to secure Zohr-like assets in the region.

However, few IOCs are in a position to invest in expensive exploration because of the low oil price. "Given the current very low prices of oil, we will need to see which companies finally submit bids," said Taliotis. "[Low prices are] obviously a concern for expensive deepwater projects. On the other hand, costs of exploration have also come significantly down and the need will always exist in IOCs to show additional reserves," he added.

ExxonMobil is rumoured to be interested, but it is unclear whether this could translate into a bid. Much will depend on the assets IOCs already hold in the region and how Cypriot acreage fits into each company’s overall strategy. If other IOCs decide to participate in the tender "it may not be plain sailing for Eni and Total", Ellinas warned.

Cyprus may have been able to attract more competitive offers for blocks 6, 8 and 10 if it had delayed its latest licensing round to wait for oil prices to recover. The oil price is certainly weighing on the ministry. "The current conditions in the oil and gas industry are a concern to us of course," said Lakkotrypis.

Cyprus’s decision to proceed with the licensing round anyway is perhaps explained by a desire not to be left behind by other emerging gas players in the region, such as Israel and Egypt. The government may also want to show it can drive the development of the hydrocarbon industry despite low prices.

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].