Directional impact on forecast:

Upbeat for US LNG exports to Europe

The FID taken on the Golden Pass LNG project in early February is a crucial move in Qatar Petroleum’s (QP’s) plan to remain a reliable and dominant LNG supplier in the medium-to-long term. Golden Pass will allow QP and ExxonMobil – the project’s two stakeholders – to serve the European LNG market and thereby free up more volumes for the Asian market from Qatar’s Ras Laffan plant. This will go hand in hand with the plan to expand Ras Laffan’s capacity from its current 77 mtpa to 110 mtpa.

Golden Pass is QP’s masterstroke – it will help the company defend its share of the LNG export market while enabling Qatar to fend off competition from other liquefaction projects in the United States, Australia and Russia.

QP has a 70% stake in the Golden Pass liquefaction project, with Exxon accounting for the rest. The facility will have three 5.2 mtpa trains, the first of which Exxon expects to come online in 2024. Golden Pass currently functions as a regasification facility, but the plan is to equip the site with export capabilities as well.

QP intends to invest over $10 billion in the project – a significant part of the $20 billion it plans to invest in the US energy sector. Saad Sherida al-Kaabi – Qatar’s minister of state for energy affairs – has announced that Golden Pass will not be QP’s last investment in the US. This leaves the door open for the project to be expanded if it proves a commercial success.

European market in sight

The proximity of Ras Laffan to the Asian market means Golden Pass can become QP’s main LNG supply source to Europe. Qatar exported 14.85 mt of LNG to Europe in 2018, and the three trains at Golden Pass will have enough capacity to equal this volume.

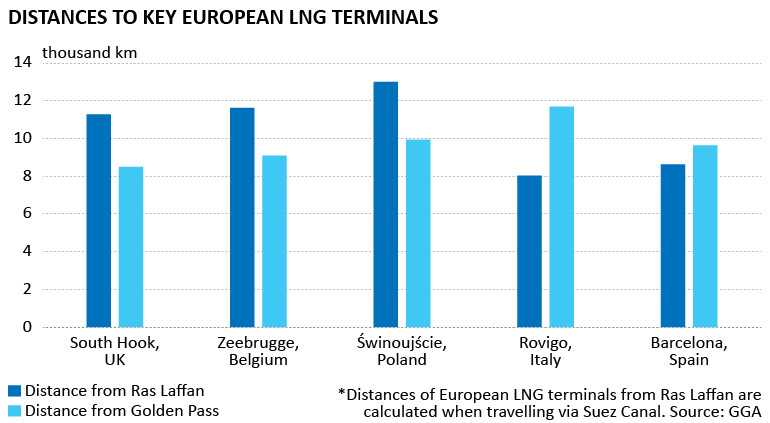

QP and Exxon will be particularly interested in supplying cargoes from Golden Pass to European LNG terminals such as South Hook in the UK, Zeebrugge in Belgium, Świnoujście in Poland, Rovigo in Italy and Barcelona in Spain. These five terminals together accounted for around 77% of Ras Laffan’s LNG exports to Europe in 2018.

Average transport costs could be cut by almost one-quarter compared with exports from Ras Laffan if Golden Pass is used to supply South Hook, Zeebrugge and Świnoujście. GGA estimates this could have saved QP around $96 million in transport costs alone during 2018.

There will also be a strong case for using Golden Pass to supply Rovigo and Barcelona, even though these facilities are closer to Ras Laffan. This is because journey times from Ras Laffan to key Asian LNG-consuming countries will be shorter than those from Golden Pass, even if cargoes were to transit the Panama Canal. For instance, transport costs could be cut by one-third if QP were to ship LNG to Japan’s Sakai terminal from Ras Laffan rather than Golden Pass. Furthermore, the canal’s limited transit capacity and its inability to handle Q-Flex and Q-Max vessels also count against sending Golden Pass cargoes to Asia.

- Liked this article?

- Stay informed with exclusive, accurate and up-to-date energy news, analysis and intelligence. Sign up for 7-day trial access to more premium content. It's free!

- Get a free trial