Directional impact on forecast:

Upbeat on Qatar’s LNG exports

Qatar is thinking long term. The country is working to ensure it remains a reliable LNG supplier for the next decade and to fend off competition from the likes of Australia, the United States and Russia. Qatar understands the Asian market will be central to achieving its targets, a fact shown by Qatar Petroleum’s (QP’s) plans to streamline its LNG supply portfolio.

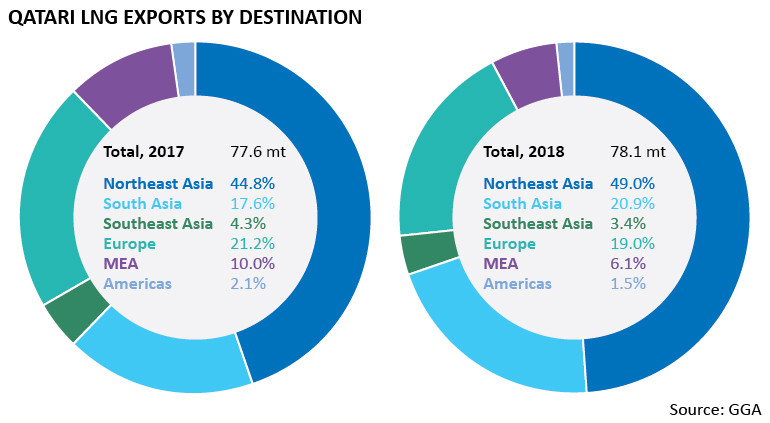

The emirate exported around 78 mt of LNG in 2018, of which just over 73% was dispatched to Asian countries. Qatar’s LNG exports to Asia rose by 10.5% on an annual basis in 2018, even though its liquefaction trains were running at capacity. Weakening demand for LNG in Latin America, the Middle East and North Africa, together with Qatar’s ongoing dispute with some of its Gulf neighbours, has caused the emirate to send more of its cargoes to Asia. More importantly, this demonstrates that Qatar is able to find alternative markets for its spare LNG.

Qatar intends to expand its liquefaction capacity from 77 mtpa currently to 110 mtpa. The first LNG from the expanded capacity could materialise as soon as 2023, with the entire project expected to come online by the end of 2025 or early 2026. Asian buyers will be prime contenders to absorb the additional volumes.

Qatar’s evolving trade strategy

Qatar is warming up its trade relations with China, with Qatargas having signed a 22-year oil-indexed sales-and-purchase agreement with PetroChina in September 2018 to supply 3.4 mtpa of LNG. Beijing’s ongoing trade war with Washington could see more Qatari LNG going to China. Qatargas has so far supplied commissioning cargoes to seven Chinese terminals. Qatar shipped 9.14 mt of LNG to China in 2018, marking a year-on-year increase of 20.3%.

South Asian markets will be of particular interest to Qatar as its proximity to India and Pakistan means lower transport costs. Consequently, Qatar has oil-indexed long-term contracts with both countries and delivered Bangladesh’s first-ever cargo in 2018 under a similar contract. Qatar dispatched 16.35 mt of LNG to South Asia in 2018, which was a rise of almost 20% year on year.

The proposed Golden Pass LNG plant in the US could further increase Qatar’s trading flexibility in the European market, effectively freeing up more volumes from the Qatari Ras Laffan plant for the Asian market. QP is the major stakeholder in Golden Pass, with ExxonMobil and ConocoPhillips having smaller stakes. The project – on which an FID is expected in 2019 – will have three 5.2 mtpa trains, the first of which could come online in 2023. Qatar exported 14.85 mt of LNG to Europe in 2018, and Golden Pass will have enough capacity to equal this volume.

Qatargas and Exxon also have controlling stakes in the South Hook terminal in the UK and the Rovigo terminal in Italy, which together received almost 45% of Qatar’s exports to Europe in 2018. This strategy has allowed Qatari cargoes to head to Europe or Asia depending on the prevailing market conditions and will further boost Qatar’s trading flexibility when Golden Pass starts exporting.

- Liked this article?

- Stay informed with exclusive, accurate and up-to-date energy news, analysis and intelligence. Sign up for 7-day trial access to more premium content. It's free!

- Get a free trial