Kurdistan to offer 20 blocks in licensing round

6 December 2016 Iraqi Kurdistan’s Ministry of Natural Resources will offer 20 blocks in next year’s licensing round.

Iraqi Kurdistan’s Ministry of Natural Resources will offer 20 blocks in next year’s licensing round.

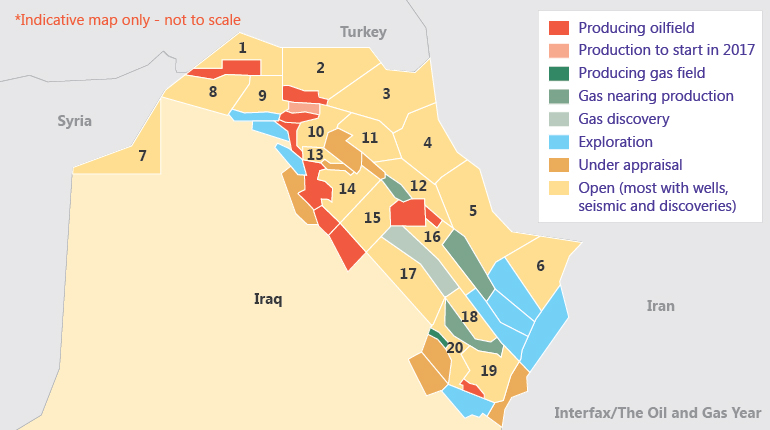

Iraqi Kurdistan’s Ministry of Natural Resources (MNR) will offer 20 exploration blocks to IOCs in a licensing round to be held next year. The licences include several blocks previously awarded to IOCs but handed back to the MNR when tumbling oil prices forced oil majors to cut their exploration budgets.

Boosting investment in its oil and gas sector is a priority for the Kurdistan Regional Government (KRG). "The oil price collapse has slowed exploration in Kurdistan, just like everywhere else. However, we have plans to boost that [with the 20 licences]," Ashti Hawrami, the KRG’s minister of natural resources, told delegates at the Kurdistan-Iraq Oil & Gas conference in London on Monday.

The MNR has redrawn the boundaries between the blocks and hopes to reallocate the acreage in its latest offering. "We have redrawn all of the block boundaries, particularly resulting from relinquishments from the last 2-3 years, coupled with open blocks which existed before," said Hawrami.

ExxonMobil recently relinquished three of its six licences, and the areas will be offered to IOCs again. Kurdistan will also try to find interested parties for several unexplored blocks. All blocks that lie along its borders with Turkey and Iran are on offer.

"Most of them have seismic data and wells and some have discoveries. This is a very attractive opportunity for current explorers in Kurdistan and new investors."

Each of the blocks has 2D seismic data that has already been gathered and 3D seismic is available for several of them. A total of 47 wells have been drilled in the areas included in the licensing round.

Bidders will soon have access to a data room, according to MNR officials. The ministry has asked interested IOCs to register on their online tendering system by January.

Exploration opportunity

Kurdistan would benefit from greater exploration and is still relatively under-explored. "It’s a great place to look for oil and gas," said Steve Lowden, chief executive of New Age, which holds a 60% stake in the region’s Shewashan discovery. "To be able to access a province of this quality and onshore in [an] environment like this in 2016 is extraordinary."

According to company estimates, Kurdistan holds 3.3 trillion cubic metres of gas and 50 billion barrels of oil in potential reserves, in addition to 821 billion cubic metres and 11 billion bbl in proven reserves.

Even so, many IOCs have experienced disappointment in Kurdistan over the past five years. Speaking at the same conference, DNO’s Executive Chairman Bijan Mossavar-Rahmani pointed out that in 2011, when Kurdistan’s output amounted to 190,000 barrels of oil per day, the KRG announced it would export 1 million b/d by 2016. Reality has fallen short of this target, he said, with only 550,000 b/d currently being exported from Kurdistan.

The fight against Islamic State, over-inflated expectations and unpredictable payments from the KRG mean IOCs are hesitant to invest further, said Mossavar-Rahmani. "DNO and our partner Genel can’t commit any more funds without predictable payments from the KRG and a plan to recover their arrears from oil that has already been shipped from Tawke."

Reasons to invest

Hawrami said that this was an unfair assessment, adding that the KRG has paid for oil – although payments have been late.

IOCs may want to invest in Kurdistan despite low oil prices and the security situation because of the low lifting costs and the opportunity to work with a business-friendly government, he said.

"Nobody believed Kurdistan had oil 7-8 years ago, but we had the best companies come and invest in our region based on some geological studies […] I think what really attracts people to the region is […] that we have demonstrated that we can meet our contracts [and] make payments – although sometimes we are a bit late – and […] the win-win between the investor and the state," said Hawrami. "There are very few regimes around the world to choose [from] so I’m confident in the launch of our new exploration blocks."

The MNR has yet to present the terms it will offer to IOCs, which could sway potential investors. Claims from IOCs that Kurdistan is a difficult place in which to do business are overblown, said Hawrami.

"If Kurdistan is not such a good place with $2 per barrel [production], take your money elsewhere," he said. "But the fact is that Kurdistan is still a fantastic area for exploration. I am confident in the 20 blocks we have next year. Mark my words, a lot of them will be contracted."

Talk to us

Natural Gas Daily welcomes your comments. Email us at [email protected].

Liked this article?

To access similar premium content, you or your organisation must have a paid subscription. Sign up for a free 7-day trial to demo this service or call +44 (0)20 3004 6203 and one of our representatives would be happy to walk you through the service.

Sign up