Gate LNG terminal, Netherlands. (Gate LNG)

Gate LNG terminal, Netherlands. (Gate LNG)

The prediction that there will be an LNG supply glut to 2020 and beyond is now the conventional wisdom in the market. The world’s available liquefaction capacity is expected to rise by 50% between 2015 and 2020, and almost all of this has just become operational or is under construction. It is important to consider available capacity rather than nameplate capacity. Available capacity can be less than nameplate because of maintenance, incidents of force majeure (such as in Yemen), operational issues and/or feedstock problems. Actual capacity can also be higher than the nameplate if the plant manages to send out more LNG than advertised (such as in Papua New Guinea).

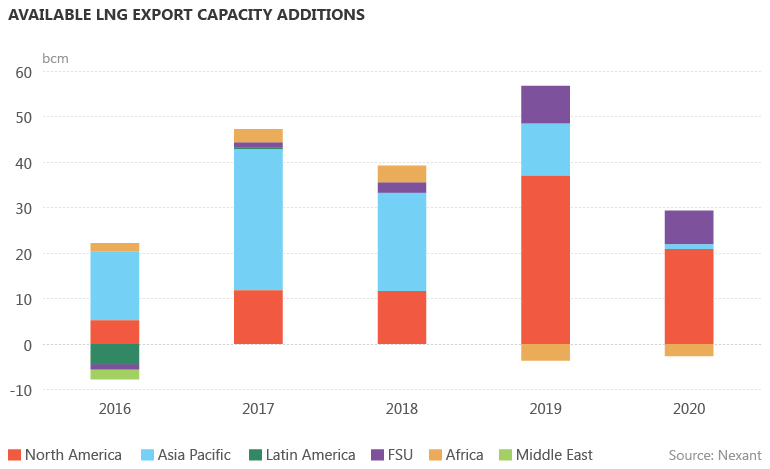

As shown in the figure Available LNG export capacity additions, capacity is expected to increase significantly in the next few years. The capacity added between now and 2020 will come mainly from the United States and Australia, in addition to Russia’s Yamal LNG in 2018 and 2019 plus Cameroon FLNG by 2020. The cumulative increase in available liquefaction capacity by 2020 is expected to be around 180 billion cubic metres compared with an average capacity of 364 bcm in 2015.

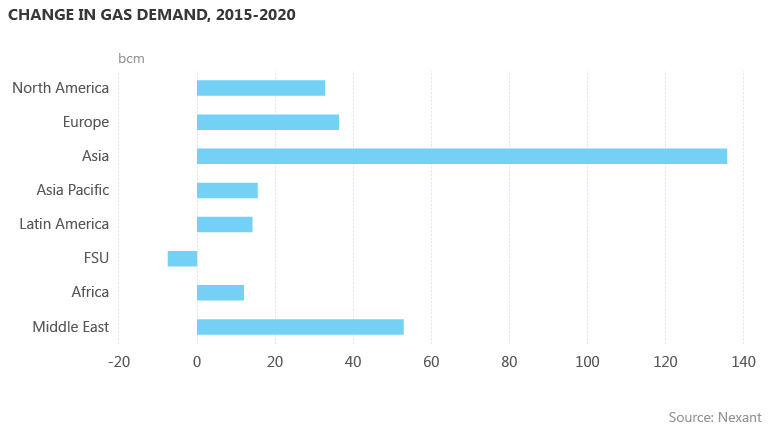

The extent to which this extra capacity is utilised depends on how much is contracted and how much demand increases in importing countries. The next figure, Change in gas demand, 2015-2020, examines the change in demand by region between 2015 and 2020.

Global gas demand is expected to rise by around 300 bcm between 2015 and 2020, which is consistent with the International Energy Agency’s World Energy Outlook 2016 New Policies Scenario.

The Asia region – which includes China and the Indian subcontinent – is expected to show the strongest growth, particularly China. The increased demand will partly be satisfied by greater domestic production and, in China’s case, pipeline imports. In Asia Pacific, demand is quite weak outside Indonesia, which is expected to consume increasing volumes of LNG in its western islands that will predominantly be supplied by the Bontang and Tangguh plants in the east. Middle Eastern demand growth will largely take place in Iran, Qatar and Saudi Arabia, and will mostly be met with domestic production. In Europe, demand growth was stronger in 2015 and 2016, reversing declines in previous years; this trend is expected to continue, particularly in the UK and Turkey as the latter recovers from two years of declining demand.

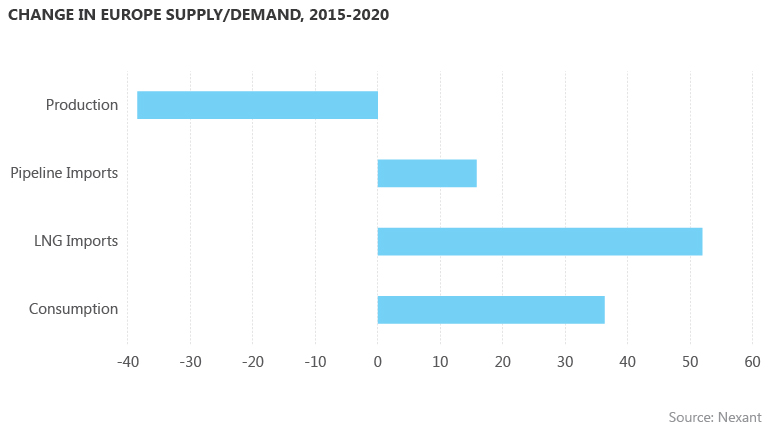

Europe faces a widening supply-demand gap, as illustrated in Change in Europe supply/demand, 2015-2020. Production is expected to decline by around the same amount that consumption increases by – so between 2015 and 2020 the supply gap is set to widen by 75 bcm. Lower production will be seen in the Netherlands as the Groningen field’s cap bites, and also in the UK and Norway after 2018 as fields start to decline.

Europe increased its pipeline imports from both Russia and Algeria in 2016. There is some scope for further increases from Russia, but both the Nord Stream and Yamal pipelines are capacity-constrained, in part by the offtake capacity in Germany. While Algeria is trying to boost production, this still largely leaves LNG imports to fill the rest of the gap, if the projected level of demand is to be satisfied. LNG imports into Europe are expected to double, increasing by around 50 bcm between 2015 and 2020.

Of this 50 bcm rise, around 30 bcm is expected to be sourced from the US as six export facilities there become operational, although these flows will not start to any great extent until 2018. Exports from Russia’s Yamal LNG are also expected in 2019 and 2020.

While LNG export capacity will increase by 180 bcm between 2015 and 2020, LNG imports will increase by only 140 bcm over the same period, resulting in a growth in underutilised LNG export capacity. The level of unutilised capacity fell slightly in 2016 as demand marginally outstripped the rise in supply. The level of unutilised capacity expected between 2015 and 2020 largely reflects plants that are not necessarily fully contracted and buyers not taking the full Annual Contract Quantity (ACQ) but only their contracted take-or-pay levels.

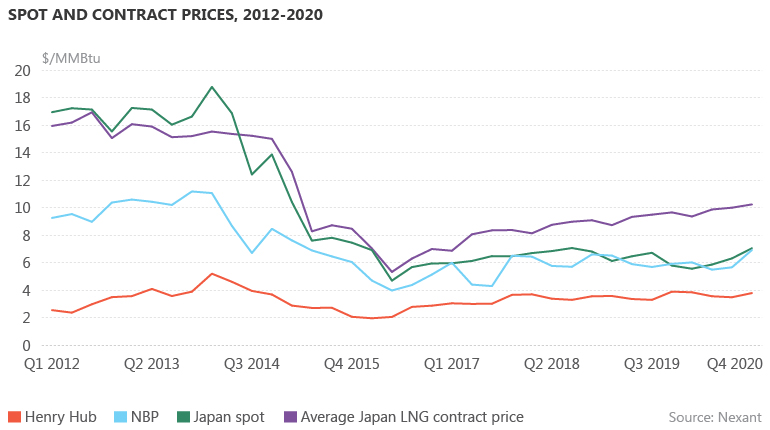

This level of underutilised capacity might be expected to depress spot prices even further. That is not expected to happen to any great extent, however, since this capacity – largely located in the US and Australia – will be held off the market, providing some support to spot prices. Combined with an expected rise in oil prices to around $70 per barrel by 2020, spot prices in Europe and Asia are expected to remain broadly at current levels or marginally above, as illustrated in Spot and contract prices, 2012-2020.

Henry Hub prices are projected to rise to around $4/MMBtu as LNG exports increase the requirements on US gas production. The average contract price for LNG entering Japan rises in line with the price of oil to around $10/MMBtu in 2020. Meanwhile, Japanese spot prices and the NBP average around $6/MMBtu, with the NBP slightly below the Japanese spot price, but no significant Asian premium is expected through to 2020.

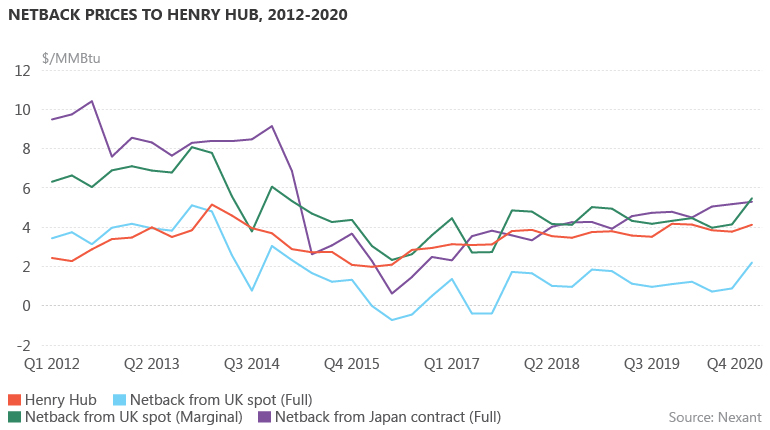

As US LNG exports increase they will become increasingly important in driving spot prices around the world. Netback prices to Henry Hub, 2012-2020 shows the netback to the Henry Hub from NBP and Japanese oil-indexed contract prices using the Cheniere-style contract. For example, the netback from the NBP on a full-cost basis is the NBP price less the regas (and entry) charge, the shipping cost, a $3/MMBtu tolling fee and the 15% uplift to Henry Hub. This netback calculation is well below the Henry Hub price, meaning these contracts are ’out of the money’ on a full-cost basis when it comes to delivering LNG to Europe. However, on a marginal-cost basis – which excludes the $3/MMBtu tolling fee – the netback is slightly above the Henry Hub for the most part. This suggests offtakers will still lift the LNG as they are receiving some contribution towards the tolling fee. If the marginal netback were to fall below the Henry Hub then some US LNG would likely be shut in, resulting in lower Henry Hub prices and higher NBP and other spot prices until the marginal netback is restored to above the Henry Hub.

It is also noticeable that, as oil prices rise to $70/bbl, the netback from the oil-indexed average Japanese contract price rises above the Henry Hub on a full-cost basis. This makes US LNG very attractive to Asian buyers and offtakers.

There are many uncertainties surrounding this outlook to 2020. Both Europe and China will play key roles in absorbing the growing LNG supply, but demand is not expected to increase enough to absorb all the new capacity. If non-US export plants with unutilised capacity, especially those in Australia, did choose to send more spot LNG into the market then prices could be expected to fall below the levels shown in the preceding chart. In the event of this happening, some US LNG might be shut in if the netback to Henry Hub from NBP declines on a marginal basis. However, lower European prices may be just enough to unleash a sharp increase in gas consumption in power plants in Europe, as has happened in the UK following the introduction of the carbon floor price. About 40-50 bcm/y of gas could begin to be used in gas-fired power stations in Europe relatively quickly if gas prices were more competitive with coal prices.

The European gas market and US LNG are increasingly acting as balancing mechanisms to clear the global gas market, setting the trend for spot prices.

Mike Fulwood is the Director of Global Gas & LNG at Nexant Limited, a globally recognised consulting, services and software provider in the energy and chemicals industries. Mike has over 35 years’ experience in the gas industry. Mike can be contacted at [email protected].

The outlook and analysis presented above was generated using Nexant’s World Gas Model. http://www.nexant.com/software/world-gas-model

- Liked this article?

- Stay informed with exclusive, accurate and up-to-date energy news, analysis and intelligence. Sign up for 7-day trial access to more premium content. It's free!

- Get a free trial